The Supreme Court and the student debt decision

This topic might seem like a reach in a blog with the title of Funeral Director Daily. However, there are a great many funeral directors working in the field right now whom this decision will probably affect in a negative fashion and owners of funeral homes, who have these young people as employees, need to be cognizant of that fact.

And, from my perspective as a former Board Member of a large land-grant university, The University of Minnesota, I have some perspective on this issue that many of you have probably not thought about.

First of all, employees who have student debt will probably soon be affected by the moratorium on monthly principal and interest payments soon ending. That will mean less “free-cash” an employee has in his or her monthly budget. It may mean employees will be looking to employers to help make up for that loss of “free-cash” in the form of increased wages. Employers should be aware of this.

So, where did the thought process of President Biden wander to to believe that he had the ability, as President, to not only suspend the payments, but forgive the debt to America of about $400 billion from former students who used that money to pay for educational purposes?

It wasn’t so far-fetched, but I think it was wishful thinking on his part to believe it could be done without a look at the United States Constitution for its legality. In 2003, the HEROES Act was passed by Congress. The Act passed by Congress and signed into law authorized the Secretary (of Education) to “waive or modify any statutory or regulatory provision applicable to student loan programs under title IV “as may be necessary to ensure that” the Secretary could alleviate hardships individuals suffered because of September 11 and any subsequent terrorist attacks. . .

Later, before the HEROES Act expired, Congress extended the Act to, according to President Biden’s team interpretation, “Notwithstanding any other provision of law, unless enacted with specific reference to this section, the Secretary . . . may waive or modify any statutory or regulatory provision applicable to the student financial assistance programs under title IV of the [HEA] . . . as the Secretary deems necessary in connection with a war or other military operation or national emergency to provide the waivers or modifications . . . “

The national emergency (highlighted above by this writer) was the Covid-19 pandemic. Using that train of thought, and including “national emergency” the Biden team believed that they had justification and authority to “modify” and even “cancel” student debt.

Tom Anderson

Funeral Director Daily

From my point of view, in a simplistic look at the issue by the Supreme Court of the United States, I believe that the Supreme Court looked at the issue more of a “Separation of Powers” issue whereby the appropriation and spending of money for our government must be voted or ratified by Congress. The Supreme Court looked at the $400 billion of student debt that would not be collected and put in the government coffers and decided the amount could not be ignored as potential income to the citizens of the country simply by a Presidential directive. Again, in my opinion, allowing a President to have that authority without any checks and balances by Congress would not be in tune with the “Separation of Powers” clause of the United States Constitution. Finally, in my opinion, I think that is, at least the main reason, why the Supreme Court ruled as they did.

I also believe that the student debt could be forgiven with an affirmative vote of the U.S. House and U.S. Senate. Under the current make-up of those bodies, however, that is not likely to happen. That is why President Biden issued his directive. . . he saw no other path.

So, what about student debt? Does America have a great problem with it?

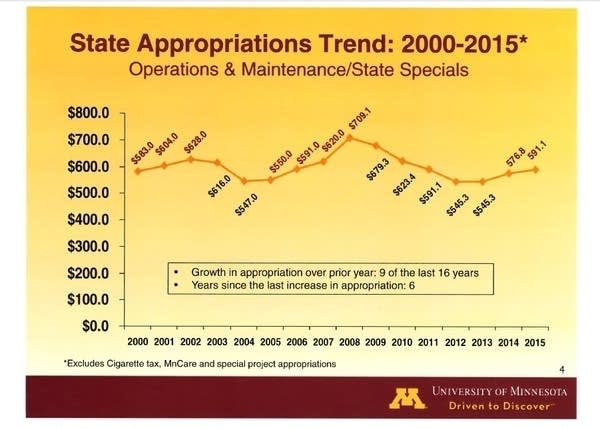

Going all the way back to the Revolutionary War’s Treaty of Paris in 1783 when America acquired the Northwest Teritory (Michigan, Ohio, Indiana, Illinois, Wisconsin, and part of Minnesota) from the British, higher education in America was meant to be a “public” good. But I’ve learned, especially in the past 40 years how most state legislatures have turned what was to be a “public” good into a “private” good — paid for by its users. For instance, the graphic below will show the Minnesota Legislature’s appropriations to the University of Minnesota from 2000 to 2015. As you can see, the appropriations for Higher Education In Minnesota have been stagnant. . . yet in those 15 years the Biennial Budget for the State of Minnesota went up over 62% — from $24 bilion to $39 billion.

To pay the rising costs of college, with state appropriations flat for higher educational purposes, the only other way to raise the revenue for the college is to charge those students going to the college higher tuition. In essence, less taxpayer support means higher student payments are necessary. State legislators have simply found other uses for these “Higher Education” appropriations. Taxpayers can argue the merits of those decisions, but the fact remains that Higher Education, across the country, has not fared well in the past couple of decades when it comes to state appropriations.

When I attended college, state legislators appropriated approximately 2/3 of the cost of college attendance and students paid about 1/3 of the cost. Today, that formula has absolutely flipped whereas taxpayers, through their legislatures pay about 1/3 of the cost and students pay about 2/3.

Quite frankly, the thought of “private good” is not all bad. . . those who get the benefit pay for that benefit. Many believe that is the way it should be. And, there are guaranteed student loans to do that with. About one-half of the students at the University of Minnesota use debt to pay for their education. . .and that average debt is about $29,000 for those students when they graduate. If they graduate and find employment in their chosen field, that’s not an insurmountable amount and, by having that degree, they are probably making more money than without a degree – which allows for a a large enough personal cash-flow to make those payments.

The big debt is held by medical students, dental students, veterinarian students, and law students. Those students can, over the course of 7 or 8 years of college amass quite a bit of debt. However, it is relative in that upon graduation in those fields, most of them have the earning capacity to pay the debt back and still live lives with a high amount of discretionary income.

The biggest issue with student debt, in my opinion, is those students who don’t get guidance about the costs of college or are simply unsure of their futures. I have found those with the biggest student debt problems are those students who fund college expenses with student loans and then, for whatever reason, don’t finish their intended four-year degree — they drop out of college after one or two years. They now have the debt but not the degree. So, they have the debt burden but not the benefit of a degree that would allow for higher earning capacity. . . . . there lies the biggest problem.

Here’s a suggestion for employers: We continue to hear that funeral directors, morticians, and embalmers are in scarce supply. We also hear that margins in the business continue to thin making wage increases tougher and tougher to pass out to employees.

Have you ever thought of paying a “lump-sum” principal payment on an employee’s student loan? It could help lead to employee longevity and stability at your firm. For instance, for five years you could pay an annual principal payment of $1,000 on the first employment anniversary and $2,000 on the second employment anniversary. . on to $5,000 for the 5th year.

After 5 years you would have paid a total of $15,000 off the principal of your employee’s student loan. And, I would guess you would have a pretty loyal and grateful employee and their longevity at your firm should have brought in that $15,000 in revenue to balance the added expense by their 5th year. . . . Just a thought!!

More news from the world of Death Care:

- TPG Capital finds banks ready to fuel PE buyouts. Bain’s turn is next. Australian Financial Review (Australia)

- Judge declines to close St. Louis funeral home cited for mishandling bodies and unsanitary conditions. St. Louis Post-Dispatch (MO)

- Palmerston North funeral director Phil Cottle shares insights into the final farewell. NZ Herald (New Zealand)

- Grand Island will be home to state veterans cemetery by Spring 2025. Video story and print article. KSNB Channel 4 – Grand Prairie (NE)

- Natural burials are the way to go. The Meaford Independent (Ontario, Canada)

- Fontana Mortuary and Ingold Funeral and Cremation will offer Full-Circle Aftercare. Fontana Herald News (CA)

- Little Rock funeral home continues to serve others with the help of the community. Fox16.com – Little Rock (AR)

Enter your e-mail below to join the 3,289 others who receive Funeral Director Daily articles daily:

Tom,

Good assessment on the Supreme Court’s reasoning. It seems most objective observers were concerned about the impact of permitting the Executive Branch that level of authority if the debt forgiveness had been permitted without the Legislative Branch acting on it.

The University funding issue is a bit more complex, I believe. First, the Minnesota Legislature’s funding for higher ed has changed over time. Earlier in our state’s history, the U of M was pretty much the only public show in town. now the Minnesota State system educates far more students than the U of M. In addition, the University’s discontinuation of General College and University College reduced the total number of Minnesota students attending the University of Minnesota’s Twin Cities Campus. These things are noted by the Legislature.

Also, in the 90s, the Legislature began directing a substantial amount of its higher education investment to the State Grant-in-Aid program, which sent funds directly to students. This acts like a voucher system of sorts, which is of course appreciated by private colleges that have access to those public dollars through Minnesota students. Today, that program receives close to a third of the state’s higher ed funding.

On the cost side, you understate the problem a bit. U of M students have many forms of debt beyond just student loans through the federal program. Private loans, mortgages, credit card debt, and other types of borrowing are taken on by students to get college degrees.

Yet the guaranteed student loan debt is even higher than reported in your post. Over 60% of U of M student graduate with this type of loan debt, and the average among those students in over $40,000.00. This used to be medical and law school debt, but now it applies to economics and English majors among all the others. It also means that for every student who graduates with $5,000.00 in student loan debt, another graduates with $75,000.00 in that type of debt. You can imagine what their credit card debt looks like after four years on top of that.

Why is this happening? When you consider how much the state still puts forward to the University, the Grant-in-Aid program funding, and the fewer U of M students, it’s a challenge to put the problem at the feet of the Legislature.

If we look at the University itself, since 1995, the U has more than tripled tuition even when inflation is factored in. At the same time, what has happened to the number and compensation rate of administrators? In 1995, the U of M President was paid $155,000.00, which is just over $300,000 today after inflation. Yet the last permanent U of M President after “bonuses” was scheduled to receive $1.2 million in compensation. This is wholly inappropriate for a public executive who is supposedly committed to access to public higher education. It also leads to 9and is used as justification for) compensation rates for other University personnel that far exceeds both what was paid for similar positions at the University in prior eras and for similar positions in other public settings.

Unfortunately, there have been few folks in a position to reverse this trend who see the problem and are willing to stand up to the prevailing winds and the social pressure inside the University and higher ed in the interest of future students as prior public leaders had done for the University’s first 150 years.