Park Lawn reports 3rd Quarter. . . .continued growth

Park Lawn Corporation (PLC), the funeral home and cemetery operator, with headquarters in Toronto and Houston, announced their 3rd Quarter 2020 results last week. As a growth company, they continued to exhibit those traits — with revenue for the quarter growing to $83.7 million from last year’s 3Q revenue number of $66.5 million (all dollar amounts, unless otherwise indicated in this article are in Canadian dollar denominations). That’s an increase of over 25% on the top line.

Park Lawn Corporation (PLC), the funeral home and cemetery operator, with headquarters in Toronto and Houston, announced their 3rd Quarter 2020 results last week. As a growth company, they continued to exhibit those traits — with revenue for the quarter growing to $83.7 million from last year’s 3Q revenue number of $66.5 million (all dollar amounts, unless otherwise indicated in this article are in Canadian dollar denominations). That’s an increase of over 25% on the top line.

You can access Park Lawn’s 3rd Quarter report here.

Even if you exclude new acquisitions made by the company, PLC reports that their top line revenue increased approximately 11.1% in a “same store” comparison with the 3rd Quarter of 2019.

For the first nine months of 2020, Park Lawn reports over $ 242 million in revenue compared to about $ 175 million for the first nine months of 2019. That’s an increase of over 38% year over year.

Earnings from Operations increased to $ 8.9 million for the quarter compared to 3Q 2020’s $ 6.7 million. . . .that’s an increase of 33% and for the nine months ended September 30, 2020, Earnings from Operations increased to $ 27.4 million over 2019’s 9-month earnings of $ 18.8 million — an increase of 45%.

Park Lawn Corporation also announced that they had “strengthened their Balance Sheet” with a completed $ 86.3 million of Senior Unsecured Debenture Financing. You can read a press release from Globe Newswire on that here.

The company, in their earnings report also issued an update as to how COVID-19 had affected them. Here are some excerpts from that information:

” . . . Although we continued to see an increase in revenue from comparable business operations during the quarter related to both the cemetery and funeral businesses, this has stabilized somewhat from the second quarter. Many of the Company’s businesses throughout the U.S. experienced positive growth from both at-need sales, that may or may not be directly or indirectly related to COVID-19, and pre-need sales.”

“Comparable pre-need cemetery revenue significantly increased during the quarter as many regions relaxed stay at home orders and the trigger effect of the pandemic created a compelling platform for our sales counselors. “

“As the Company has settled into the COVID-19 environment, we have gained confidence and comfort in our contingency planning procedures.”

“Despite the confidence in and implementation of our operational directives, we continue to closely monitor COVID-19 as the resurgence of cases throughout North America continues to pose a threat to the health and economic wellbeing of our employees, their families and the families we serve. As the circumstances evolve, our principal focus is ensuring the safety of each of these individuals to the best of our ability . . “

You can access Park Lawn’s Earning Call transcript here. Here’s a couple of excerpts on that:

From Daniel Millett, Chief Financial Officer:

“The company’s cemetery businesses experienced strong sales, both in at-need sales that may or may not be directly or indirectly related to COVID-19, as well as pre-need sales, where our sales teams were able to utilize various tools to support communications with families in terms of end of life planning.

On the funeral side of the business, while both at-need and pre-need sales remain strong, many jurisdictional restrictions imposed as a result of the COVID-19 pandemic were eased in many areas of Canada and the United States during the quarter. This generally allowed us to return to pre-pandemic service capacity, but continued to impact ancillary items and reduced the overall revenue per service relative to the first quarter of 2020.

Finally, many of the acquisitions made over the past year have seen increased sales, as these businesses are integrated and transitioned into the broader company. Recent acquisitions such, as Baue, Horan and Journey Group have experienced sales increases over the comparable quarter and internal expectations.”

From Brad Green, Chief Executive Office:

Brad Green

Park Lawn CEO

“In August, we discussed the fact that we were still experiencing strong pre-need property sales and that continued throughout Q3. Again, in addition to our strong sales culture, we attribute this continued strength in pre-need property sales to the fact that the pandemic is a trigger event.

Additionally, we saw an increase in at-need volume in both the funeral and cemetery side of our business. However, unlike the second quarter, these increases were not concentrated or in so called hotspots, but rather were spread across all of our markets.

So while a portion of the at-need increase may have been related to the COVID-19 virus, it’s very difficult to make that determination given the fact that we did not have any major operations in these particular hotspots during the quarter.

Finally, while we still saw a decrease in the average funeral sale, there was significant improvement going from 7.2% to 3.7% from Q2 to Q3. While this improvement is encouraging, average sales continue to fluctuate as various jurisdictions tighten and relax regulations and we expect to see further fluctuation in Q4 and into the new year.”

Funeral Director Daily take: A good quarter of growth and what we have come to expect from this company. I did look on the interest rate that is being paid on the debentures that Park Lawn placed during the summer. As CFO Millett mentioned, the company was looking to flexibility over cost.

Millett from the earnings call transcript: “You will also see that our interest expense this quarter was higher as we utilize our credit facility to fund the acquisition of new business over the past year, and more recently, we utilize funds from our debenture financing to reduce our credit facility balance. This provided Park Lawn significant financial flexibility, with a slight increase in our cost of financing.”

Now, debentures by their definition are unsecured which do allow investors to demand a higher rate of interest. I believe that PLC’s are for five years with a 4-year call date option and PLC is paying 5.75% interest on such.

Again, nothing wrong with that cost as long as you know what you want from the financing package. However, I’m also seeing companies not afraid to go “long-term” on financing to tie in the low rates that are available. Again, I’m not a credit analyst, nor am I a banker, but I do always look for the best possible way to pay off debt.

With your funeral home or other business, this might be a great time to look at your loan package and see if you can maneuver a better payment schedule and term. Some companies like medical device company Medtronic are using this pandemic financial situation to their best advantage.

You may be aware that in some localities internationally interest rates for savers have dipped into negative territory. Medtronic is taking advantage of their financial strength and using that to reduce debt payments. They are using European banks to pay 0% for as long as five years and only about 1.625% on bonds out as far as 30 years. Article on this here.

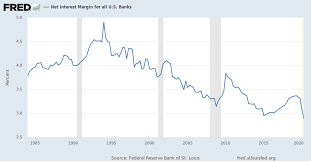

When you take a look at this graph of net margin interest in the U.S., you will see that not only are interest rates low, but banks appear to be very competitive, as evidenced by the lowest margins in 30 years. From my point of view, if you believe that your business is operating well and will be for the foreseeable future, now might be just the time to lock in a long term loan for an acquisition, a new facility, or remodeling.

Final Thoughts: Two interesting items that I found in the footnotes of the Park Lawn Corporation 3Q report were these:

- The company reported “Geographic Segmented Revenue” based on the location of the customer. Now, it has not been so long that Park Lawn was a company based and operated almost 100% out of Toronto. For the 3rd Quarter of 2020, their Geographic Segmented Revenue of $ 83.7 million came about 87.5% from the United States, and about 12.5% from Canada.

- Earlier, Funeral Director Daily reported on a disagreement and lawsuit involving the company and former CEO Andrew Clark that you can read here. According to notes in the 3Q 2020 report “Legal costs are $491,547 for the nine and three month period ended September 30, 2020. Legal costs related to the departure of the former CEO, the defense of intellectual property created by the Company and the preservation and recovery of investments made or authorized by the former CEO.”

Disclaimer — The author of this article holds a stock position in Park Lawn Corporation.

Enter your e-mail below to join the 1,652 others who receive Funeral Director Daily articles daily: