Learning more of Matthews International

Over last weekend while doing some research I stumbled across this article on Matthews International. As you may know Matthews is the parent company of Aurora Caskets and Matthews Cremation. What you maybe don’t know is that they are a world-wide conglomerate who is making a big bet on the electric car market with a dry cell battery division (Saueressig) that counts Tesla as its number one customer and, according to the article, is set to grow with other electric car makers.

The article, from Seeking Alpha and somewhat slightly dated with a January 6, 2022 print by-line, tells a lot about the company. . .including its Memorialization division. Here’s just one quote from the article about the Matthews Memorial Division:

“Matthews provides cemeteries, funeral homes, and monument dealers with a variety of products in the death care space ranging from caskets, bronze and granite memorials and cremation equipment. Matthews is a well-established player in the industry being the number one provider of cremation equipment globally.”

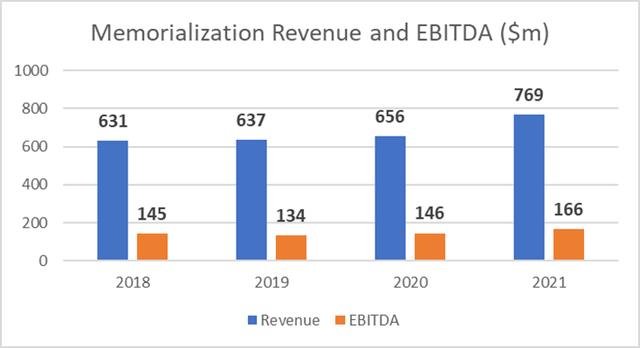

According to the article, at present the Memorial Division brings in 44% of Matthews total revenue world-wide. Here’s a graph from the article on the Matthews Memorial Division sales and EBITDA over the last couple of years:

Here’s a little bit, in quotes, about what the Seeking Alpha article says about the potential of the Saueressig/Tesla developments for Matthews:

- Tesla is currently the largest customer of Saueressig and upcoming partnership with SalesForce Group, a JV lead by Porsche will propel the battery business toward $400-500M in 2025.

- The energy storage solutions segment of the company despite being the smallest one right now it is the one with the most potential. It is led by Saueressig, a subsidiary acquired by Matthews in 2008

- Tesla is currently 80%+ of MATW’s energy solutions and as Tesla ramps up its gigafactories and dry cell, the company expects this business to double in 2022 and double again in 2023.

Funeral Director Daily take: Matthews is an interesting company, and one in which few people, including those in the death care industry know the depth of. Death care businesses know of its cemetery, cremation, and burial products but not of much of the rest of the company. To me, the company is a lot like Hillenbrand Industries that got its start in death care also — Batesville Caskets.

And in my opinion, both have been smart to use the cash-flow their death care segments bring in to widen the scope of their customer base into other products. Here is how the Seeking Alpha article now describes Matthews:

“Matthews International Corporation (NASDAQ:MATW) is an industrial conglomerate with diverse lines of business. The company offers automation and brand solutions to a variety of companies, it is present in more than 20 countries and employs more than 10,000 people. It is divided into 3 segments with an emerging new business line that is the energy storage solutions.”

I’m writing this article last weekend – actually on Saturday, April 23. So, I am using the stock price and dividend yield specific to that date which shows that of all Death Care Index stocks, Matthews International has the highest yielding dividend at 2.77% with a payout of $0.88 annually with a stock price of $31.73.

Enter your e-mail below to join the 2,674 others who receive Funeral Director Daily articles daily:

Wow! Who knew? Diversification, the name of the game.