Investors prove wary of traditional funeral home stocks in 2023

In a year when the “Magnificent Seven” technology stocks led a robust rebound in the technology heavy NASDAQ stock index it appears that investors in traditional funeral home and cemetery public companies looked on with a wary eye as to how those companies would fare moving into the next stage of death care operations.

It appears that the “Magnificent Seven” stocks propelled the NASDAQ index to a level over 43% higher at the end of 2023 than at the beginning of 2023. Most people will opine that it was the stocks with potential for a business upside due to the optimism of “Artificial Intelligence” (AI) that led this NASDAQ stampede.

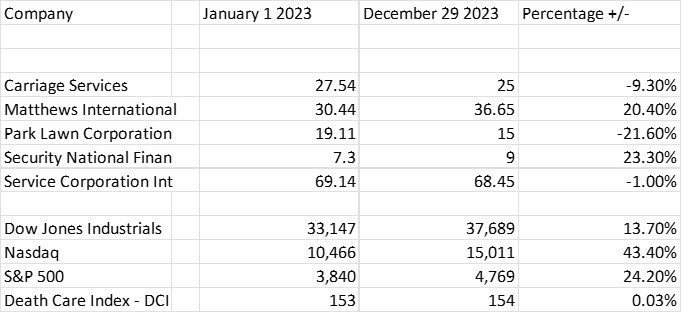

And while the NASDAQ, Dow Jones Industrials, and the S&P 500 all showed good gains for the calendar year of 2023, the North American public companies involved almost exclusively in the traditional funeral and cemetery business all showed declines in their stock price for the year.

As you can see from the chart below, industry leader Service Corporation International (SCI) as well as publicly-traded companies Carriage Services and Park Lawn Corporation all had declines in the price of their stock. You can also notice that the Funeral Director Daily Death Care Index (DCI) which is representative of the additive total of five death care stocks was virtually flat on the year.

It is interesting to note that two companies that help comprise the Death Care Index, Matthews International and Security National Financial Corporation, each had, percentage wise, good gains in stock price for the year. It is also interesting to note that both of these companies, in addition to their death care businesses, operate business units outside of death care. . . . and that may be one reason why they showed positive growth in their stock prices.

Matthews International has in recent years entered the electric vehicle business with their unit that deals with the batteries for such vehicles. Security National Financial Corporation (SNFC), in addition to operating in the death care realm, also operates in the mortgage and insurance businesses.

Funeral Director Daily take: While it certainly could be coincidental dependent on the operations of each of the three traditional funeral and cemetery services stocks, I found it very interesting that all declined in some manner — some larger declines than others, but nonetheless, all declined.

Tom Anderson

Funeral Director Daily

Those in the funeral and cemetery business know that interest rates and inflation have raised the cost of doing business for most traditional funeral homes and cemeteries. In addition, the North American consumer is believed to be taking a long look at how much they are willing to pay for death care services which seems to be driving a new norm of more low-cost direct cremations and a lesser percentage of the more high-revenue traditional earth burial services.

In addition, anecdotally, it appears to me that the rate of death care acquisitions by existing funeral homes slowed down in 2023. . . .maybe that was because of the cost of money for the purchases — i.e. higher interest rates. If that was true of the public companies it would certainly slow their growth rate. . . .and, investors like high and fast growth rates.

Another factor, in my opinion, that may be slowing down the price of these stocks is their, relatively, low dividend payments. Some investors are not so concerned with growth of an investment if they can rely on a quarterly dividend to be paid to them. All three of the traditional funeral home and cemetery public companies offer a dividend payable . . . . .However, as of last Friday, the yield on those dividends stood between 1.7% and 2.5% dependent on the company. Again, in my opinion, in today’s world with higher bond and bank deposit yields, those existing yields will not perk up dividend investors.

It may just be that until they can prove otherwise, these public companies may be caught in a world of too little growth and too little yield for investors to pay more attention to them.

Disclaimer — The author of this article for Funeral Director Daily holds stock positions in Service Corporation International and Security National Financial Corporation.

An interesting note about Artificial Intelligence (AI): This article will tell you about Microsoft “Doubling Down” on AI as it is introducing a new keyboard for its products that will include an additional key dedicated to it’s Copilot function which is part of its new AI feature. It is reported to be Microsoft’s first keyboard change in over 30 years. The changes will be available on new Microsoft desktop and laptop computers in February. I include this in today’s notes simply to help you understand how much change is taking place because of the AI revolution. How AI pertains to funeral service and death care at this point is really an unknown, however.

More news from the world of Death Care:

- A.W. Lymn Chairman marks 50 years as Funeral Director and Qualified Embalmer. Derbyshire Times (Great Britain)

- Why custom cremation urns are becoming more popular. AZ Big Media (AZ)

- Reader Commentary: Will the state protect city residents from crematory pollution? The Baltimore Sun (MD)

Enter your e-mail below to join the 3,430 others who receive Funeral Director Daily articles daily:

“A servant’s attitude guided by Christ leads to a significant life”