Death Care continues to lag other market sectors

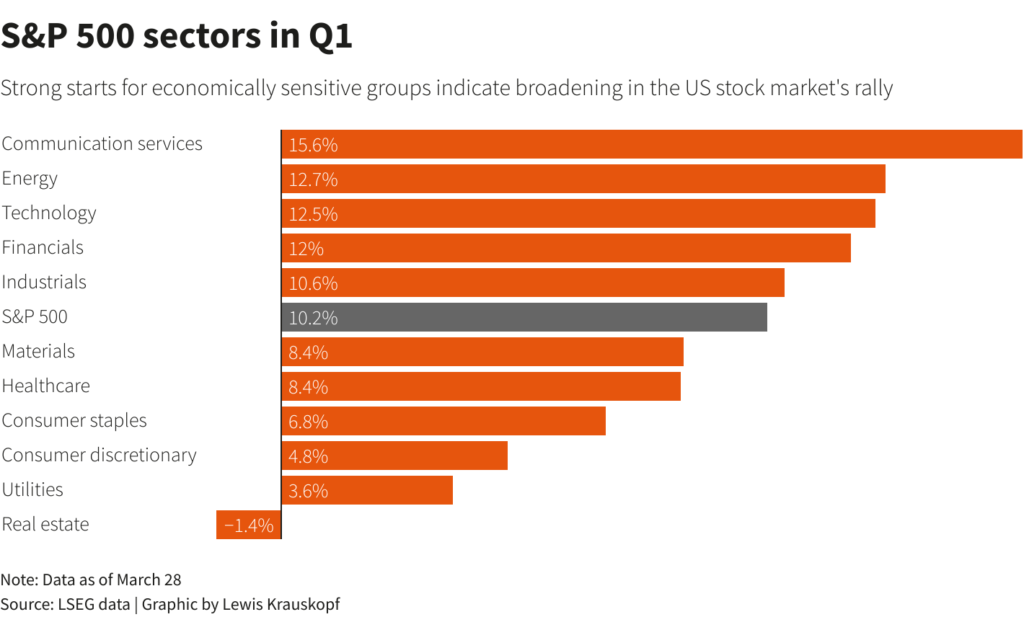

The American stock market closed on Thursday, March 28, 2024, for the last time in the calendar of the 2024 First Quarter. If you look at the results so far for the overall market for these first 3 months you would have to say that the results of the 1st Quarter as to the growth has been very good — the Dow Jones Industrials have gained at a 5.6% clip, NASDAQ at an 8.0% rate, and the S&P 500 has increased right at 10%. It would be probably pretty correct to say that anybody who has had investments in equities has had a pretty good quarter.

As per the graphic shown below it has been almost all segments of the economy that has shown equity growth. Communication and Technology sectors, buoyed by the emergence of the future potential of Artificial Intelligence in our world, have seen incredible 15.6% and 12.5% increases respectively and even “old-world” economics of Energy and Industrials have grown at an over 10% rate.

The laggard of the market has been Real Estate as it is the only “major” sector to be in negative growth territory.

What about Death Care services? Where do they land?

In these lists of “Major” sectors I am guessing that Deth Care would be a subset of Healthcare, Consumer staples, or Consumer diecretionary purchases. And, those sectors are among the smallest gainers — although growth at 4.8% of higher for a single quarter is still pretty good.

However, when you look at the public death care stocks by themselves as a unit, you will find that they actually had a loss of 1.1% for the quarter. The Funeral Director Daily Death Care Index (DCI) which consists of one share of stock for each of the five public companies in the Death Care realm — Matthews International, Security National Financial Corporation, Service Corporation International, Carriage Services, and Park Lawn Corporation — slid from a combined price of $154.10 on December 31, 2023, to $152.52 on March 28, 2024. . . . a quarterly loss of 1.1%.

Here’s the individual companies and their stock prices on those dates:

| Company | 12/31/2023 | 3/28/2024 | % Change | |||

| Matthews Intl. | 36.65 | 31.08 | -15.20% | |||

| Security National FC | 9.00 | 7.91 | -12.23% | |||

| Service Corp (SCI) | 68.45 | 74.21 | 8.41% | |||

| Carriage Services | 25.00 | 27.04 | 8.16% | |||

| Park Lawn Corp | 15.00 | 12.28 | -18.24% | |||

| DCI Index | 154.10 | 152.52 | -1.10% |

Why is Death Care trailing other sectors? — That’s a really good question but I think there are some reasons why investors have overlooked Death Care as an investible growth vehicle. Some reasons may be valid and some may not be, but here’s what I think.

Small Sample Sizes — There are only five companies that comprise the Funeral Director Daily Death Care Index. There are literally hundreds of companies that comprise the other asset sectors listed above. That makes a great deal of difference. I believe that the DCI sector is not so much a sector. . as it is the “additive summation” of a few “individual” public companies involved in Death Care. I also believe that these companies are looked at “individually” for their promise rather than the DCI looked at as a “sector” for its promise.

Differing companies — The public Death Care companies are different from each other and really don’t fit into a “box” of sameness. For instance, Matthews International, in my opinion is much more like an industrial company being a manufacturer and supplier to, not only the funeral home and cemetery markets, but to other markets as well. Security National Financial Corporation, while owning and operating funeral homes, is also in the finance, mortgage, and insurance businesses.

And, while SCI, Carriage Services, and Park Lawn Corporation are all in the funeral, cremation, and cemetery businesses, they have different structures, sizes, acquisition strategies, ambitions, and balance sheets which are somewhat a blueprint of how they operate. So, while they “do” the same thing, the companies are all different.

Tom Anderson

Funeral Director Daily

Challenges investors see in Death Care — I owned and operated a funeral home and know that there are daily challenges in operations. Efficiency was the “big key” for me and I always was working to improve the margins between what I could sell services for and what they cost me to provide. . . . and we didn’t have an increasingly expensive overhead.

From my point of view, I think potential investors see funeral homes as being challenged right now with exploding overhead expenses — everything from costs of labor, to costs of loans, to costs of utilities. And, on the other end of the spectrum they see a growth in lower cost services such as Direct Cremation with no services challenging the ability to grow revenues being brought in.

Furthermore, when you look at the corporate funeral home operations they also have the challenge of containing overhead expenses at the corporate level.

Finally, at the end of the day, it is about profits. My dad has been gone for 47 years but he used to tell me as a teenager, “Stock prices are eventually all a function of profits or profit potential.” When I look a the Seeking Alpha Income Statements from the funeral home/cemetery operators — SCI, Carriage Services, and Park Lawn Corporation — all of them show less “Earnings from Continuing Operations” for the year 2023 than they did in 2022. That also presents some challenges.

There are some positives, however. First of all, Death Care is relatively stable in an environment where many investors are looking for stability. And, while margins are lessening there is still the anticipation of a higher number of death calls coming from the aging of the Baby Bomer population.

So, some of the Death Care stocks have had a positive 1st Quarter and some have had a negative 1st Quarter in companies that virtually do the same thing. Why? I believe, in those cases, the stock price is about history and potential of the individual company more so than the industry or profession as a whole.

Related article — How the U.S. stock market rocketed through the First Quarter. Reuters

More news from the world of Death Care:

- “Green Burial” section added to Blacksburg’s Westview Cemetery. Video story and print article. Roanoke Times (VA)

- Connecticut latest state to consider “human composting” amid Catholic opposition. Catholic News Agency

- Police remove 34 bodies from English funeral home and arrest 2 for for fraud and preventing burial. Associated Press

Enter your e-mail below to join the 3,556 others who receive Funeral Director Daily articles daily:

“A servant’s attitude guided by Christ leads to a significant life”