Will “State of Mind” affect the acquisition market in 2023?

People from not only the United States, but from almost every country around the world have seen a whip-saw of economic conditions since the pandemic year of 2020. It was a pandemic economy that saw the “stay at home” commerce of technology and furniture or home improvement sales grow by leaps and bounds and, of course, the death care economy was, in most places, buoyed by the increased pandemic deaths which led to increased profits at death care businesses.

While we can argue the causes, the results of the recent post-pandemic re-opening commerce have been tight labor markets for most business segments and a rise in the cost of living and inflationary costs of operating businesses. That’s certainly been the case in death care.

And, in contemporary death care we also have the added mystery of how fast death care is moving away from the traditional full-service casketed burial option. In the United States, I’m fairly certain that we are right at or over the 60% threshold of cremation as the chosen method of human disposition. As all of you know, it is expected that choice will continue to lower the average revenue per service over time.

For comparison sake, the annual Sun Life Cost of Dying survey in Great Britain came out with their 2022 results recently. That survey showed that in Great Britain 75% of dispositions were either cremation or direct cremation and only 25% of services were earth burial. I’m of the opinion that the United States will get to that point faster than we anticipate.

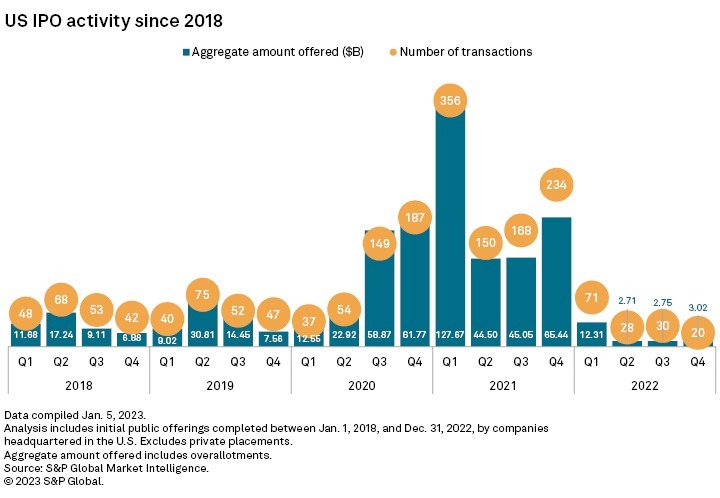

That “whip-saw” of economic conditions from pandemic to post-pandemic metrics played a role in Initial Public Offerings (IPO) in the United States in 2022. The following chart which appeared in this article from Yahoo Finance Morning Brief on January 18 shows the drop off from 2021 to 2022.

Here’s what the author of that article says about the slowdown in activity, “Rising interest rates make borrowing money for anything — a house, a car, a corporate takeover — more expensive. Which means prospective buyers either pay more or move on. On Wall Street, the preference last year was clear.”

In my opinion, part of that clearness is a “State of Mind” opinion that capital is difficult to raise in an economic downturn, or possibly, that the future was pretty foggy and not clear enough for a financial commitment.

That was followed up by this article from Yahoo Morning Brief on January 20 where that author said this, “. . company-level results often surface compelling commentary on the state of consumers and the economy. But Wall Street strategists looking at aggregate corporate profits for this quarter and the quarters ahead see one clear through line: Expectations are coming down.

Writing in a note to clients on Wednesday, FactSet’s John Butters noted earnings for S&P 500 companies are now expected to fall 3.9% during fourth-quarter earnings season. This would set up the benchmark index for its first aggregate drop in profits since the third quarter of 2020.

And the news doesn’t get much better looking further out.

“Looking ahead to the first quarter and beyond, what are analyst expectations for year-over-year earnings? Do analysts believe earnings declines will continue in 2023? The answer is yes,” Butters wrote. “Over the past few weeks, earnings expectations for the first quarter and the second quarter of 2023 switched from year-over-year growth to year-over-year declines.”

That leads me to the question in the funeral home acquisition realm, “What will this thinking do to the acquisition market?”

Do the indicators give us a market and a “State of Mind” that is conducive to the acquisition market? Here are some things to think about:

From the Buyer’s point-of view:

- Interest rates are higher

- Does the higher interest rate limit the amount I can pay because the financing will cost me more?

- What about service mix? If we are moving in a more direct cremation direction, will my revenues drop over time?

- Inflation may be lessening, if it does not continue that way will my costs increase greatly?

From the Seller’s Point of View:

- Is this the right time?

- If interest rates don’t come down, does that limit the pool of potential buyers and possibly the price?

- If my service mix is changing to lesser priced services, is the faster I sell the better?

These questions, to some extent are always asked in an acquisition. However, I think today’s economy coupled with the changing service mix in the funeral business make them more relevant than ever. And, I’m a firm believer that sometimes it is a buyer or seller’s “State of Mind” that makes these decisions and not always data that does so. Funeral home owners just know that they feel better about their business when they have come off a “Three funeral day” rather than when they have went two weeks without a death call.

I’m pretty certain that “State of Mind” is a variable in any sale. And, sometimes in the funeral business one’s “State of Mind” when looking into the future of the business can appear more half-empty than half-full.

However, the more one knows, whether a buyer or seller, the better prepared they are to make those decisions. And the more you can separate “your business” from “your emotions” the better prepared you will be to be either a buyer or a seller. Don’t let your “State of Mind” drive a decision that may not be right for you.

It’s also my opinion that one’s “State of Mind” can be taken out, or at least greatly reduced, from the equation by hiring professional help in the buying or selling of a death care business. There are several of those companies out their including Funeral Director Daily sponsor Johnson Consulting Group. You can see the services they offer here.

More news from the world of Death Care:

- OTC wins NFDA Student Arranger Training. Ogeechee Technical College News

- The FUNeral: A start to a shared grieving process. HealthNews

- Is human composting the next big thing in Jewish death practice? The Jewish News of California (CA)

- Question of McCulla Funeral Home crematory causes consternation at Westover zoning commission. Yahoo News

Enter your e-mail below to join the 3,109 others who receive Funeral Director Daily articles daily: