What is “Services” inflation and does it matter for funeral service?

This week may turn out to be one of the most consequential in recent times as to showing a direction as to how the economy turns going forward. There seems to be a lot of positive movement in the American economy at this time as just last week the S&P 500 worked its way to a position that is over 20% higher than its low point from last October. That signals a positive trend that could continue.

This week will find the financial and economic wonks looking at the May Consumer Price Index (CPI) which will be unveiled on Tuesday and then on Wednesday, using some of that data, the Federal Reserve Board will be announcing what they will be doing with interest rates. . . . at this point the money seems to be on the Federal Reserve stopping the rate hikes that have seen interest costs soar over the past year.

However, the Federal Reserve will look to the CPI and what inflation is doing as part of their decision making process. Generally speaking, if the CPI comes in at too high a rate, you would look for the Federal Reserve to raise interest rates again to try to cool off inflation. Their simple thought is that inflation cannot continue to climb. And, raising interest rates is one way to hammer away at inflation by making purchases and loans for capital projects more expensive.

I happened to read this article from Seeking Alpha author Damir Tokic just yesterday. It’s a very interesting article about how he sees the inflation situation in the country. And, I learned some things from the article such as “Services’ inflation that I was not really aware of, but I’m guessing may be an indicator of death care service costs among other things.

In the article Tokic opines that inflation, as measured by the CPI, is continuing at a much too high level of about 5% year over year. He does say, however, that “Services” inflation, “Shelter” inflation, and “Energy” inflation are beginning to fall which could be good signs to reduce inflation overall.

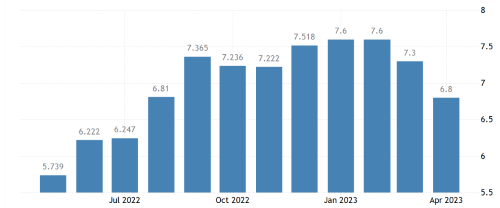

Tokic tells us that “Service” inflation was at its highest during this current stretch of inflation in January and February of 2023 when it reached 7.6% year over year. My take on that is that “Services” like funerals and cremations had a net price effect of a 7.6% increase to the consumer. And, if a death care provider did not raise their prices by that number or more they were then probably losing some margin on the prices charged the consumer for these services.

So, using that assumption, a $2,000 direct cremation in January 2022 would have had to carry a price tag of about $2,152 to hold the margin for the provider and a $6,500 professional services charge for a traditional funeral in January 2022 would have had to carry a price tag of about $6,994 to hold the margin for the provider in January 2023 assuming that their costs did increase by the “Services” inflation number. Obviously, the trick is to hold that margin and not have the consumer client family choose lesser services because of the price hike. In the death care world that is not always an easy accomplishment.

I also believe that the largest driver of increased cost to the service provider was more than likely employee compensation. The good news is that Tokic believes that the “Services” inflation is on a downward trend. However, for that trend to be true in funeral service we would also need to show compensation growing at a slower pace. I’m not so sure that is the reality at this time. Notice the graph below.

Services Inflation

Finally, however, Tokic states that for a long period of time, Service inflation held at a steady 2.5%. The inflation seems to be coming down but he says “the question is 1) how fast services inflation continues falling, and 2) at which level it stops falling. Before the pandemic, service inflation was very steady at around 2.5% level. We are long ways from 2.5% now. Service inflation is unlikely to fall back to 2% unless there is a very significant increase in the unemployment rate – or a deep recession.”

Tom Anderson

Funeral Director Daily

Funeral Director Daily: So, while the Federal Reserve Board ponders its next move they more than likely will do so without the thought of the funeral and cremation world at the top of their thoughts. But, I think inflationary pressures on both sides — the consumer budgeting their expenses for death care services and on the death care provider side by trying to keep the right pricing elasticities in a rising expense environment — are vital to the profit and loss ramifications of funeral homes.

I was reminded of that yesterday morning at church when an usher friend of mine told me he had been to a traditional casketed funeral the other day and asked me how much I think it cost. He then told me both he and his wife would like to be buried traditionally, but the costs of such may move them from that preferred choice to cremation. That is a concerning thought that I hear more and more from my friends these days.

Finally, reading the Tokic article and his thoughts that “Service” inflation held steady at about 2.5% for a long period of time resonated with me. My 35 years of death care ownership and management was sandwiched between the high inflation of the 1970’s and today’s high inflation environment. Like clockwork, I raised prices a steady 3% every January. Over time, I saw my margins increase, although my work on lowering expenses helped that cause also. However, just on the price increase alone, if Tokic is right about the 2.5% steadiness of “Service” inflation, then I gained, on average 0.5% to margin each year.

Simple margin increases of that variety are wishful thinking for today’s operators.

More news from the world of Death Care:

- Beauty and Grief: The artists of Green Burial. Psychology Today

- Young woman goes from working in hospitality to funeral home. 1 News (NewZealand)

- Sonoma County to hold first ever memorial service for 500 unclaimed people buried without a funeral. Sonoma County Department of Human Services (CA)

Enter your e-mail below to join the 3,267 others who receive Funeral Director Daily articles daily: