InvoCare receives over US$ 1 billion dollar buy-out offer

Yesterday it hit the United States business markets that InvoCare, Australia’s largest death care provider was offered AUS$ 1.81 billion in a non-binding take-over offer. According to this article on the subject from Reuters, that would equate to an offer in the amount of US$ 1.22 billion.

The offer has came from United States based TPG Global whose website you can access here. TPG Global is a large player in the private equity business and has, over the years, been involved with providing capital for some of the biggest names in business including Airbnb, Continental Airlines, and Burger King among others.

An article published by the Australia Financial Review that you can access here states that TPG Global purchased shares in the public company on Monday prior to the bid resulting in an ownership percentage of 17.8% which, according to that article, would make it difficult for any competitor to make a competing bid. InvoCare, according to that same article, said “there were conditions attached to the unsolicited, non-binding buyout proposal, including a request by TPG for exclusive due diligence. The InvoCare board said it would assess the proposal, and cautioned there was no certainty that a transaction would proceed.”

According to the InvoCare website that you can access here, the company operates 290 funeral homes and 17 cemeteries across the South Pacific. . .mainly in Australia and New Zealand. They are also the leading provider of pet cremations in Australia.

InvoCare recently released their 2022 full year financial performance and in doing so reported a revenue increase of 11.2% as their 2022 Revenue came in at AUS$ 591.37 million (US$390.8 million) as compared to 2021’s Revenue of AUS$532.5 million (US$351.53million). They did however swing from a profitable 2021 year to a Net Income loss of AUS$ 1.81 million (US$ 1.19 million) in 2022.

Funeral Director Daily take: I find it interesting that in the past year we have seen private equity play a role in privatizing some of the big names in Death Care. StoneMor, arguably the 2nd largest, by revenue, public death care company in North America was taken private late last year and earlier this year Dignity plc, Great Britain’s largest purveyor of death care services received a take private offer. Now, the same is happening with the largest player in the South Pacific.

I think it shows a movement to less risky investments by these big money groups. The world economy of late has seen technology companies retrench to try to become more profitable and the choppy economic picture has given rise to investments in debt and savings rather than in equities. . . especially high-flying equities. Maybe investors see Death Care as a somewhat safe investment with some growth potential.

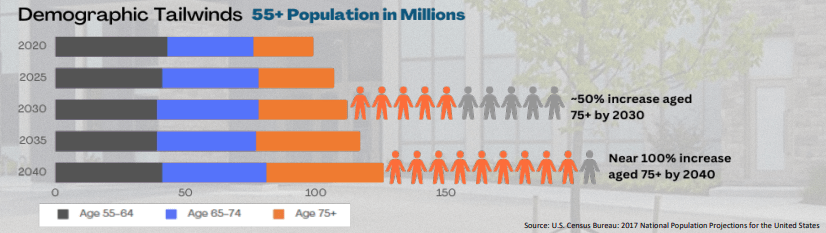

While Death Care certainly has its risks, I think that professional investors are measuring the risks and are willing to sacrifice quick, potential high-flying growth companies for the stable low-growth of Death Care. Here is a graphic that illustrates the potential positives of the Death Care market as it pertains to potential numbers of deaths moving forward in the United States.

When you see that graphic you can also see why the business outlook looks so promising to private equity. It will be interesting to see where this buy-out offer ends up at.

More news from the world of Death Care:

- Late Arizona teacher had an M & M style casket for her funeral. Video news story and print article. Fox 10 – Phoenix (AZ)

- Death industry fatally flawed for LBGTQI people. The Canberra Times (Australia)

- Divine Passage Funeral Home celebrates 10 years of service. Ripon Press (WI)

Enter your e-mail below to join the 3,177 others who receive Funeral Director Daily articles daily: