Investors shy away from Death Care stocks

The price of equity ownership (stocks) in public companies is a function of supply and demand. The more people that want to own the stock (equity or ownership in the company) the higher the price goes because the stock is in demand. Conversely, when the stock is not in great demand the price drops to a point at a lower price where buyers will eventually buy.

Most of the time the stocks in demand justify that demand and price because the company is in the process of a solid performance, potential and/or earnings and stock pickers can visualize the upside coming and/or profits continuing. On the other hand, however, stocks that are “stuck” in place or going lower are not always companies that see a downward trend on their business. . . . They can be companies that are fine companies, but at the time are just overshadowed by the growth and excitement of other industries or companies.

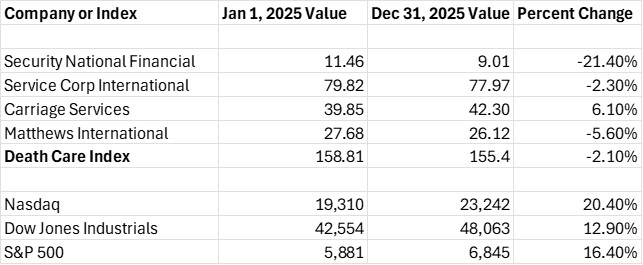

That might be an accurate description to give credence to where the stock prices of Death Care companies are today. You can take a look at the chart below and notice that the indexes of the Nasdaq, Dow Jones Industrials, and S&P 500 grew by 20.4%, 12.9%, and 16.4% respectively for the calendar year 2025. Those numbers represent a very good year for Wall Street and those that hold broad indexes of stocks.

In comparison the Funeral Director Daily Death Care Index (DCI) lost 2.10% on the year representing a loss of value if you owned one stock each of Security National Financial Corporation (SNFC), Service Corporation International (SCI), Carriage Services, and Matthews International — the four Death Care companies that make up the DCI.

My point of view is that there is more at play than just some stocks are “good companies” and some stocks are “not so good companies” at this time. And, I don’t see Death Care stocks as bad investments at all. Each Death Care company has its positive aspects and its share of challenges and they have to be looked at individually if you are a potential investor.

However, probably the biggest reason that ownership, represented by stock holdings, has not been as lucrative for Death Care as the broad indexes this past year is because the United States economy is in one of those rare moments where one or two sectors of the economy is providing much more lucrative returns than other sectors. In my opinion, it is the technology, and to a somewhat lesser extent the utility sector that will supply the energy to technology, that have grown so much that investors are putting their money into those sectors looking for better returns and leaving the other sectors somewhat behind.

So, while there are challenges in the Death Care sector, such as continued low-cost cremation choices by consumers, lower margin sales, and higher fixed-expenses, it is not the avoidance of investment in those businesses so much that has resulted in a loss of stock value, but the high percentage of investable assets going into the chase for higher returns in technology and utilities. One has to look no further than the hype of artificial intelligance, chip manufacturing, driver-less cars, and the construction of large-scale data centers to see this situation in effect.

Looking at the 2025 returns in the chart above again reminded me of famed stock-picker Peter Lynch, author of the book One up on Wall Street. One of Lynch’s premises is that “slow-growth” companies over time many times end up with higher total returns than fast-growth companies that grow and decline. In that book, according to this quote found on Gemini Artificial Intelligence, “Lynch cited Service Corporation International (SCI) as a prime example, referring to it as an “essential business” that was undervalued and often overlooked by analysts, contributing to strong long-term returns.

Tom Anderson

Funeral Director Daily

Final Word: Lynch’s book was published in 1989. However, it appears to still be contemporary over 35 years later. . . .

I arrived at our South Florida rental last Friday and will be here for the three months of the Minnesota winter. On the trip down I was fortunate to be treated to lunch near Tampa by my great friend and mentor Bob Horn, one of the Death Care profession’s Hall of Fame business people.

In discussing these 2025 stock results Bob reminded me of the dot.com boom/bust of the late 1990’s. He pointed out that during that technology-led stock price increase, much like today, Service Corporation International dropped in price by about two-thirds even though they had not changed their modus operandi.

Sure enough, I checked and in 1999 SCI stocked dropped from about $42 per share to about $14 per share. However, if you bought at $14 then and still owned the stock today you would have an approximate 6x multiple return as of today.

Just a reminder that sometimes. . . . the turtle beats the hare!!!

Disclaimer — The author of this article for Funeral Director Daily is a shareholder of Security National Financial Corporation, Service Corporation International, and Carriage Services.

More news from the world of Death Care:

- Cameron McCormack introduces Canada’s first UK-sourced aquamation technology to Sarnia. The Journal (Ontario, Canada)

- Featured Story — Progress in Funeral Leadership. Video report and news article. Hello Nation (MS)

Enter your e-mail below to join the 3,201 others who receive Funeral Director Daily articles daily

“A servant’s attitude guided by Christ leads to a significant life”