Interest rates are hurting small businesses, including funeral homes

“Interest rate increases are aimed at curtailing swelling inflation But using interest rate hikes to bring down inflation creates a whole new set of problems for small business owners,” said Aleksandar Tomic, an economist and associate dean at Boston College in this article from Business News Daily.

The United States Federal Reserve Board will meet in mid-September to ponder and decide what the next strategy step will be as to using raising interest rates to curb inflation. There are some that believe the economy is stalling and interest rates should stay stable and there are those who believe interest rates need to be raised again because their belief is the consumer is still spending strong enough to continue an upward inflation curve.

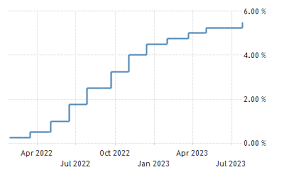

Funeral Director Daily has seen in some of the 2nd Quarter press releases that businesses are paying more in interest payments than the prior year and that is a direct squeeze to profits. And, we’ve heard from some of our readers, those with variable interest payments, that interest payments have doubled in some instances in the last 18 months.

Federal Funds Interest Rates

That type of interest rise can affect a small funeral business in a big way. Let’s say an owner has a $1 million variable mortgage on his funeral home building with an adjustable rate loan. In his case, 18 months ago the interest payment was at 4.5% annually which would result in an annual payment of $45,000 to his lender. If that has now doubled to 9%, that owner is paying $90,000 to his lender. . . . that’s money right out of his pocket — almost $4,000 per month.

It’s not only interest, but inflation too. . . that can set off a double whammy — paying more for product and then paying higher interest if you finance that product. Here’s another quote from that article in Business News Daily, “According to the MetLife-Chamber poll, 39% of small business owners have taken out a small business loan to offset higher costs in materials and supplies resulting from the surge in inflation. But they are already seeing the impact of interest rate hikes on their ability to borrow and pay back debt: 6% of small business owners in the NFIB survey reported paying a higher rate on their most recent loan.”

From my point of view, leverage and loans are vital to building equity and value in your funeral business. However, it needs to be used judiciously. . . but the situation we find ourselves in now with rising inflation and higher interest rates to combat that inflation is a tough dance to keep up with.

An added problem for funeral homes is the matter of raising your prices to combat the increases may lead clientele to use a less expensive alternative. i.e. turning otherwise would be traditional burial clientele into cremation clientele because you have raised your burial prices beyond their comfort zone. That situation is one that is not as easily seen in most other service industries such as accounting or dentistry.

Here’s a couple of articles that I found that may help your understanding of where we are and what we face:

- Fed’s Kashkari: “Not ready to say we’re done raising rates” Yahoo Finance

- Fixed vs. Variable interest rates: What’s the diference? Value Penguin

- Average Business Loan interest rates in 2023. Lending Tree

More news from the world of Death Care:

- “No animal is left behind”: Pet cemetery with more than 500 remains being excavated in Oakville. Yahoo News (Canada)

- Choose Washington’s most beautiful funeral. The Spokesman-Review (WA)

Enter your e-mail below to join the 3,338 others who receive Funeral Director Daily articles daily:

“A servant’s attitude guided by Christ leads to a significant life”