Lower wage increases coming? . . .Is that good news for employers?

There’s no doubt that for the last 3-4 years most of the news coming on the business front has resulted in employers raising wages and benefits to their employees even while other aspects of the business were not necessarily positive. For instance, inflation at higher than anticipated rates has caused most employers to absorb more costs at the same time that they were worried about raising rates to their customers. The net result is generally a compression of margins and profitability.

And, rising interest rates increased payments to banks for those businesses that had financed with adjustable rates. Finally, especially in the Death Care business there was an increase in salaries and benefits simply because of the lack of workers that has been noticed in our profession. That gave workers in the Death Care profession, like many other professions, much more leverage that they previously had in moving jobs for the sake of higher compensation.

All of those cost increases happened in an environment in Death Care where cremations and especially direct cremations has been increasing. . . which makes holding one’s revenue per case static difficult. In fact, many Death Care business have seen a decling revenue per case over the past couple of years.

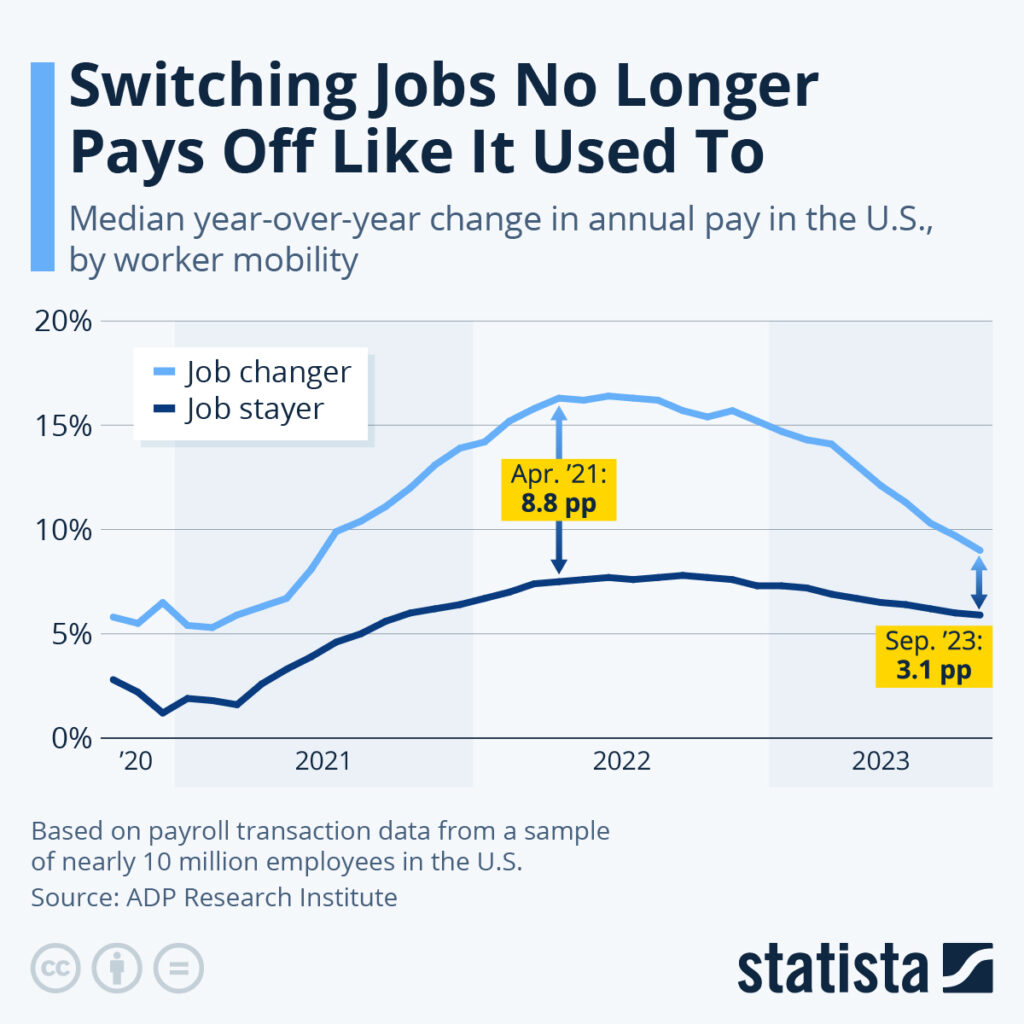

It has been noted in this period of high employment following the pandemic that in most professions a “merry-go-round” of employee movement among employers has been evident and it has been evident especially because job openings have been plentiful and available skilled employees were scarce. That resulted in a phenomena whereby employees could be rewarded for switching jobs with higher compensation increases than they could get by simply holding on to their positions and receiving an increase in salary, wages, or benefits.

Pay differential between switching jobs and stay at your present job

However, according to this recent article from Yahoo Business, “the worm seems to be turning”. The story contends that “the gap” between switching jobs for higher pay and the increases given at present jobs is narrowing leading the author to believe that many more people will be happier staying at their present position going forward. It’s my opinion that will make owners and managers jobs a little bit easier.

In addition to that information, this article from Mondo indicates that “it is projected that a significant 92% of employers are preparing for layoffs in 2024, as they navigate the economic implications of the COVID-19 pandemic and adjust for potential overstaffing during this period”.

The article does list one caveat to that prediction, . . . .”In contrast, the emergence of new work trends, such as generative AI and sustainability practices, indicates a potential surge in job opportunities and shifts in certain job roles”.

The same article in Mondo gives this listing of companies that already have begun, or have announced, 2024 layoffs:

- iRobot layoffs: 31% of workforce laid off (January 2024)

- Jamf layoffs: 6% of workforce laid off (January 2024)

- Salesforce layoffs: 1% of workforce laid off (January 2024)

- Paramount layoffs: Unspecified amount of workforce laid off (January 2024)

- Business Insider layoffs: 8% of workforce laid off (January 2024)

- TIME magazine layoffs: 15% of editorial staff laid off (January 2024)

- SAP layoffs: 7% of workforce laid off (January 2024)

- Vroom layoffs: 90% of workforce laid off (January 2024)

- The Los Angeles Times layoffs: 20% of newsroom staff laid off (January 2024)

- Brex layoffs: 20% of workforce laid off (January 2024)

- X (Alphabet’s moonshot lab) layoffs: Undisclosed dozens of jobs laid off (January 2024)

- Citigroup layoffs: 8% of workforce laid off (January 2024)

- Prime Video & MGM Studios layoffs: undisclosed hundreds of workforce laid off (January 2024)

- Macy’s layoffs: 3% of workforce laid off (January 2024)

- Wayfair layoffs: 13% of workforce laid off (January 2024)

- Riot Games layoffs: 11% of workforce laid off (January 2024)

- TikTok layoffs: <1% of workforce laid off (January 2024)

- Microsoft layoffs: 8% of workforce laid off (January 2024)

- Levi Strauss & Co. (Levi’s) layoffs: 10%-15% of workforce laid off (January 2024)

- REI layoffs: 2% of workforce laid off (January 2024)

- eBay layofffs: 9% of workforce laid off (January 2024)

- Sports Illustrated layoffs: <1% of workforce laid off (January 2024)

- Discord layoffs: 15% of workforce laid off (January 2024)

- Amazon Audible layoffs: 5% of workforce laid off (January 2024)

- Pixar (Disney+) layoffs: <20% of workforce layoffs announced (January 2024)

- NBC News layoffs: 1-3% of workforce layoffs (January 2024)

- CitiGroup layoffs: 8% of workforce layoffs announced (January 2024)

- Universal Music Group NV layoffs: Hundreds to be laid off (January 2024)

- Google layoffs: <1% of workforce laid off (January 2024)

- Amazon Twitch layoffs: 35% of workforce laid off (January 2024)

- Treasure Financial layoffs: 60-70% of workforce laid off (January 2024)

- Duolingo layoffs: 10% of contractor workforce laid off (January 2024)

- Sharpie & Rubbermaid (Newell) layoffs: 7% of workforce laid off (January 2024)

- Rent the Runway layoffs: 10% of corporate roles cut (Early 2024)

- Unity layoffs: 25% of workforce laid off (January 2024)

- Blackrock layoffs: 3% of global workforce laid off (January 2024)

- Pitch layoffs: Two-thirds of employees laid off (January 2024)

- BenchSci layoffs: 17% of workforce laid off (January 2024)

- Flexe layoffs: 38% of staff eliminated (January 2024)

- NuScale layoffs: 28% of staff laid off (January 2024)

- Trigo layoffs: 15% of workforce laid off (January 2024)

- Xerox layoffs: 15% of workforce laid off (January 2024)

- InVision shutdown: Entire company by end of 2024 (January 2024)

- VideoAmp layoffs: Nearly 20% of workforce laid off (January 2024)

- Orca Security layoffs: Roughly 15% of staff laid off (January 2024)

- Frontdesk layoffs: Entire 200-person workforce laid off (January 2024)

Tom Anderson

Funeral Director Daily

Funeral Director Daily take: I’m very cautious about the business environment going forward in 2024 until interest rates start receding. Right now I see some of our smaller banks in an “upside down” world. As extra consumer money from the pandemic has been spent these banks are competing for deposits. . . .some giving certificate of deposit rates of 5.5%.

At the same time, while competing for loans in the pre-pandemic world of 2019 these same banks were giving ten-year business loans with fixed rates of 3-4.5% — my church received a 10-year loan in 2018 at a 3.5% fixed rate. That puts these banks in this “upside down” world of paying 5.5% and only bringing in 3-4.5% on some of their existing loans. Even for the best credit worthy borrowers right now, I would be cautious of having to get debt financing for some portion of my business, since I think interest rates will be higher than previous for some time from small regional and local lenders because of this fairly recent “competition for deposits”.

And, funeral home owners generally have great relationships with local banks. . . but at this time, again because of the battle for deposits, smaller local banks may not be as competitive with their loan rates as in the past.

That’s just one reason why I think the cost of doing business coming down, as in smaller wage increases, may be a good thing, and welcome by funeral home operators at this time. However, it will be a balancing act. . . . being too tight with wages may lead to an exodus of employees that you cannot find replacements for.

Related — It’s somehow hard to comprehend what looks like growing job opportunities in the USA and then see these amounts of lay-offs in certain businesses. For instance, just last Friday the United States had an overwhelming positive employment issue number reported for the month of January 2024. Here’s an interesting comment from Ernst and Young’s Economist Gregory Daco on that seemingly diametrically opposed issue:

“Over the past year one thing that has continued to impress has been the pace of job growth. But increasingly that has been dominated by two sectors: government and health & social assistance, accounting for 76% of job growth in Q3 and 83% in Q4. When one considers that over 50% of health care payers are governmental agencies maybe we should really consider these two sectors as one. I think this says two things. First, maybe the rate hikes did work. The part of the economy that is not government or government-affiliated has eked out only modest job gains recently. Second, as these two sectors get staffing back on-sides we can expect they will deliver fewer job gains, and overall employment growth should continue to slow.”

More news from the world of Death Care:

- Death is not a life event you can skip — and the cost is rising. Morningstar

- Updated: Remains to renewal: Delaware bill considering human composting passes House. Coast TV – NBC – Dover (DE)

- Dimon graduates with honors from PIMS. The News-Item (PA)

- Dimon Funeral Home website

- A final resting place in the garden? Bill would allow human composting in Utah. The Salt Laek Tribune (UT)

- Michigan township bans all cemeteries to prevent family from starting one. Reason

Enter your e-mail below to join the 3,458 others who receive Funeral Director Daily articles daily:

“A servant’s attitude guided by Christ leads to a significant life”