Will funeral homes go the way of banks?

Over the weekend I started reading death care industry consultant Alan Creedy’s new book entitled, “Finish Well“. I really enjoying the read, but so far have not gotten too far into the subject matter so I will save a review until another time.

However, in describing most family funeral homes in the book, Creedy compares them to the definition by financial experts of “small business” in the United States as a business that does under $20 million in revenue. Most family funeral homes, according to Creedy, do less than $2 million in revenue and thus could be considered by the financial experts as “Micro-businesses”.

From my point of view, it really doesn’t matter how we define them, but it does lend me to argue that the smaller the business you operate, the more susceptible you might be to changes in your traditions. On one hand that is probably true, but one could also argue that the smaller you are, the faster you can pivot when traditions change.

So, while this article does have some similarities when I make a comparison about banking and funeral homes, there is also that difference that family funeral homes, being so entrepreneurial in nature, also have the ability to pivot to avoid fast changes.

I started to think about this when I read this article about the banking industry in the United States. It comes from Yahoo Finance and is entitled, “Why does the U.S. have so many banks”? Do we have a lot of banks? According to the article, the United States finished 2022 with 4,127 banks.

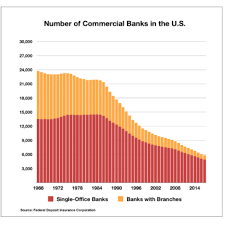

Let’s compare that to funeral homes. . . . where it is estimated that we have over 18,000. Here’s an indication of how banks have decreased over the past 60 years.

I was also interested to learn from the Yahoo Finance article that there was a big disagreement back in the time of our country’s independence from Great Britain if we should have a large single National Bank or let the states charter their own competing regional banks. When you consider what’s been happening in the last couple of months, you understand that that argument has really never gone away.

Regional banks, though, like community funeral homes offered competition and honed one’s business capabilities in the Darwinian fashion. I don’t think that is, or was, a bad idea. Competition, in my opinion, is good for capitalism and democracy.

You can see from the above graph, when the banking business got tough in the early 1980’s, along with America’s recession at that time, the country lost a lot of banks. I’m guessing that many became “branches”, but I think that there were a lot that just simply disappeared — although depositors’ money was safe as the acquisition banks continued even without the smaller banks that they bought out.

I can remember a small local Savings and Loan where we had a 3% fixed 20-year note on some future business property. The bank came to us and offered a discount if we paid off the loan early. My dad had recently died and we didn’t have much available cash. . . as much as we would have liked to help that bank, we couldn’t pay it off. I’m guessing that there were many people in our boat.

Well, the ramifications for that bank was they were having to pay up to 16% on certificates of deposit to attract accounts and were receiving 3% on loans much like ours. They were taken over by a larger bank, which within a year or two was taken over by an even larger bank which is now one of America’s top ten banks.

As an aside to this article, that was about the time that I started really pushing preneed and in Minnesota preneed had to be deposited in interest bearing accounts at that time. We ended up having a ton of preneed funeral accounts that were being guaranteed 16% interest, for up to seven years, while our costs were going up maybe 5%. . . . .when those clients died, the family chose to spend a lot on the funeral and, in most cases, got a refund back from the amount that was in the account.

We were happy. . . and, they were happy!!!

In any regards, back to the article. What I want to point out here is that when banking somewhat changed because interest rates went up faster than every one thought they would, many banks were caught in “upside/down” positions which led to the “strong” acquiring the “weak” and a net loss of the banks available to consumers.

The premise of this article is my assumption that funeral homes have entered into a threshold where we are doing things “differently”. It is no longer casketed services or even cremations with memorial services. We are seeing more direct cremations with no services. We are seeing more competition with alternative event planners in the death care space. We are seeing other alternatives such as green funerals, alkaline hydrolysis, and natural organic reduction seeing slow, but sure gains.

My question is, “Will some small funeral home operators find themselves “upside/down” with expenses over revenues with no clear cut way to recover?” And, if so, will that lead to a decrease in funeral homes as we saw happen in the banking industry?

I think that there is a better than even chance of that. . . . and in those cases, just like with banks in the 1980’s, the Darwinian concept will emerge and many will disappear but be taken over by the larger players with economies of scale. The question will be. . . .how many?. . .how fast?

“Finish Well” by Alan Creedy — I couldn’t mention this book without giving you an idea of how to get your own copy. Click here for more information and ordering instructions on this new book for funeral home owners and those that would like to own a funeral home.

More news from the world of Death Care:

- In our Catholic Cemetery, cremation demands the same dignity and respect as full-body burial. Baker City Herald (OR)

- “It’s just about being part of your community”– Irwin Chapel for Funerals. The Intelligencer (IL)

- The Irwin Chapel website.

Enter your e-mail below to join the 3,208 others who receive Funeral Director Daily articles daily:

Great article Tom – summed up very very well mate.

There certainly are some very interesting times ahead – across the market as a whole – some good- some bad- some better- some worse. So often the ” Crystal Ball ” is full of smoke and mirrors and thus even a surprise for many that didn’t see the Train coming !

I particularly agree with and like where you Tom offer & wrote …” but one could also argue that the smaller you are, the faster you can pivot when traditions change “….Ohhh how very true mate, – like a Rat up a drain pipe ! 🙂

I respect your opinions and read your column regularly; you made a misnomer in this article, most owners of small volume firms are not entrepreneurial. If they were they would be seeking acquisition opportunities to grow revenues and make their businesses more valuable. Instead they continue to beat a dead horse, the dead horse being the business model pioneered by their fathers and grandfathers in the 1950’s-through 1980’s when a 200 call or smaller firm could flourish on 95% traditional funerals. The business model fails during a period of 55% cremation and a growing number of on-line cremation businesses offering $1100 cremation disposition.

Further evidence of their non-entrepreneurial attitudes is their failure to employ the strongest marketing tool available to them, IE: a productive website and digital marketing. Digital marketing is perfect for smaller volume firms as it allows any media budget to be effective, as opposed to traditional media, IE: newspaper, yellow pages, radio and television.

To build on your point, many small volume firms will be upside down with too much of their equity tied up in their facility. There will be ample opportunities for acquisition during the recession, allowing owners to liquidate their real estate, and continue their careers as staff funeral directors with salaries greater than their current income as owners.