Let’s have some fun. . . .

Funeral Director Daily recently published an article on the merits of Guaranteed Preneeds vs. Non-Guaranteed Preneed contracts. In that article we discovered an inflation calculator that helped us explain the costs involved as insurance value grows and the cost to provide a funeral also grows.

I had some fun with the calculator and also decided it would be fun to see how costs of items, including funerals, have grown in the past 45 years. . . . . And, not only grown, but grown against other types of expenses and purchases.

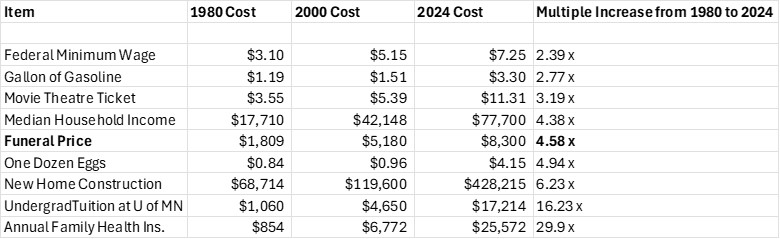

The following table will show nine categories that I looked up prices. I looked up “average” prices for the years 1980 (when I entered the work force), 2000 (when approximately today’s 45-50 year olds entered the work force) and last year (2024). I then took the 2024 price and divided by the 1980 price which gives an approximate of the multiple that that particular product has increased in 44 years.

For funeral home pricing I looked at the cost of a traditional funeral that included professional services and casket but no cemetery or monument costs. My study found those prices by, in general, looking up National Funeral Director Association (NFDA) statements on the subject. . . . This exercise is not meant to be absolutely scientific but more a general feeling of where funeral costs fit in the overall price increase equation.

Here are the categories that I found easily accessible and the data I found on the subjects. As you can see, traditional funeral prices have increased an approximate multiple of 4.58 times the 1980 costs. While that multiple is larger than some items I found including median household income, it is certainly less than new home construction or the cost of post-high school education and family health insurance premiums.

Costs of Products/Services from 1980 to 2024

Tom Anderson

Funeral Director Daily

Funeral Director Daily take: I think that this chart puts funeral costs into perspective. From my point of view, funeral homes have done pretty well in holding down costs of these services when you look at the comparison to the Median Household Income multiple — they are very similar.

So, if price isn’t the problem, what is? The problem for funeral home profitability is that the percentage of casketed, traditional funerals has went from about 85% of the total Death Care services in 1980 to probably about 35% of total Death Care services in 2024. And, that large decrease is back-filled by cremation services which bring in less revenue.

Undergraduate Tuition — There is no doubt that there are two main factors responsible for the growth of Higher Education undergraduate tuition. The first is the fact that state legislatures, with their appropriation choices, have made Higher Education a private good rather than a public benefit good. Virtually, all legislatures have increased the appropriations for Higher Education at lower levels than most other budget line items. In my state of Minnesota, the legislature appropriated 7.1% of the budget to Higher Education in 2000 and that number is only 5.2% of the budget in 2024.

The result of that choice is that when I went to college in the 1970’s, the State of Minnesota contributed about 75% of the cost of college while I paid about 25%. . . . I learned from my time on the U of Minnesota Board that that ratio has now been “flipped on its head” whereby a state picks up about 25% of the cost and the student and/or their family picks up 75% of the cost. Legislators have found other uses for monies previously appropriated to Higher Education.

Secondly, the advent of “Guaranteed Student Loans” has allowed colleges to raise their prices without a serious budgetary thought process. Students who really want to go to college are simply walked over to the financial aid office and instructed how they can finance their eduction not always realizing the ramifications of debt repayment in the future.

Health Care Costs — America faces a crisis if Health Care premiums and the costs that require those premiums cannot be dealt with. On the other hand, America has raised its life expectancy on its citizens to 79.25 years from 73.61 years in 1980. So, Americans are getting a life-span of almost 8% more in those 44 years. . . .What price is that worth?

Personally, I don’t think it is the Health Care insurance premiums that are the problem. . . . it is the medical costs driving those premiums. People a lot smarter than me have to figure out how to get those costs in check if we are going to see a decrease anytime soon. And, if we don’t see a decrease in health care costs all businesses, including funeral homes, are going to see headwinds to profitability in the case of continually rising employee health insurance benefits.

Will Technology help? — I always think of my time on a regional Wells Fargo board when I think of technology. Banks have greatly increased their profitability because of technology — in the case of banks, internet banking specifically.

I can remember when Wells Fargo was just starting internet banking around the years 1998 or so. One aspect I remember from a meeting is that it was brought to our attention that a bank transaction involving a teller cost the bank about $1, a bank transaction using an ATM machine cost the bank about 10 cents, and an internet transaction cost the bank less than 1 cent. That’s a big reason banks pushed internet banking so much.

And consider that from that time, banks have went from having about 90% of their transactions with a teller to probably about 90%, or more, of their transactions online. . . . . .That technology has been a huge money maker for banks — especially when you consider they have less need for large, high priced locations and less use of consumer face-to-face staff.

I’m waiting to find out what the technology will be in Death Care that will have that result.

More news from the world of Death Care:

- Leavenworth moves forward with cemetery expansion. The Leavenworth Echo (WA)

- Natural Organic Reduction or “Human Composting” now burial option in Minnesota. Yahoo

- The cost of dying is going up but, where is the cheapest place to be buried or cremated? Stuff (New Zealand)

Enter your e-mail below to join the 3,191 others who receive Funeral Director Daily articles daily:

“A servant’s attitude guided by Christ leads to a significant life”

Some good observations, Tom.

When I started my apprenticeship in 1978, my preceptor explained that his observation was that funeral prices double every 8-10 years. The times I applied that rule, it seemed pretty darn close.

I bought my first FH in 1999 and the burial vs cremation relationship was 80% to 20%. When I sold it 12 years later, the percentages were flipped. At the same time, several local churches were starting to offer “memorial packages,” offering the space, guestbook, memorial DVD, service folders, columbarium, and refreshments/ catering. They were telling their members that all they needed the FH for was to cremate their family member and the church would handle the rest. This further eroded revenue/case.

That is just a small piece of the pie representing the changes in funeral service that we have experienced.