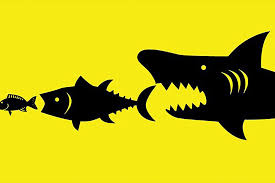

Independent operators. . . . .know your value

Back in 1990 I spent about three days north of Vancouver, British Columbia, along the Campbell River fishing for salmon with a group of funeral industry people. One of the days was spent in a small fishing boat with a gentleman about thirty years my senior who had spent almost his entire funeral service career as an acquisition target expert for the large corporate entities. Suffice it to say, I listened and learned a lot about the mergers and acquisition businesses during that day of fishing. An interesting thing about that discussion is that over the next thirty years I have never seen or heard from that man again. . . we had our discussion and went our separate ways. . . and I never got a chance to thank him for what I learned.

Back in 1990 I spent about three days north of Vancouver, British Columbia, along the Campbell River fishing for salmon with a group of funeral industry people. One of the days was spent in a small fishing boat with a gentleman about thirty years my senior who had spent almost his entire funeral service career as an acquisition target expert for the large corporate entities. Suffice it to say, I listened and learned a lot about the mergers and acquisition businesses during that day of fishing. An interesting thing about that discussion is that over the next thirty years I have never seen or heard from that man again. . . we had our discussion and went our separate ways. . . and I never got a chance to thank him for what I learned.

I was reminded of him when I read a couple of things recently about mergers and acquisitions and then learned about some acquisitions specific to the death care profession.

Here is the first item I read as printed in Seeking Alpha. This quote pertains to business in general and not just the death care industry, “Mergers and acquisitions enjoyed their best performance in two decades in Q1 (2021) at $1.1Trillion. The amount reported of public companies buying private companies rose to $435B in Q1, up 86% from the year-ago period, according to a Bloomberg estimate. North America led dealmaking with $644B, followed by Europe at $286B and Asia Pacific at $261B.”

The second item I read was in the Park Lawn Corporation (PLC) press release about their 4Q 2020 and Full Year 2020 financial results. In that press release, that you can read here, they touched on the fact that they had made four recent corporate acquisitions. Those acquisitions were in Texas, Wisconsin, North Carolina, and Tennessee. The press release also told us that those acquisitions included nine funeral homes that together did a total of 1,659 calls.

The second item I read was in the Park Lawn Corporation (PLC) press release about their 4Q 2020 and Full Year 2020 financial results. In that press release, that you can read here, they touched on the fact that they had made four recent corporate acquisitions. Those acquisitions were in Texas, Wisconsin, North Carolina, and Tennessee. The press release also told us that those acquisitions included nine funeral homes that together did a total of 1,659 calls.

In each of those four acquisitions, PLC described the acquisition in one of these terms: “a bolt-on to our presence”, “a complement to PLC’s existing operations”, or “greatly expanding our presence in”.

Those descriptions brought me back to my fishing trip of 30 years ago when the gentleman said to me something like this, “The strategies and corresponding pricing to purchase funeral homes will be different for each buyer. A seller needs to know how others may value his funeral home before he puts it on the market.”

What’s interesting to me about the Park Lawn acquisitions is the number of calls produced. Their stated 1,659 calls divided by nine funeral homes acquired comes to an average of 184 calls per funeral home. When you look at the national public companies in funeral service, you might think that number is a smaller number of calls than those companies would be interested in. However, there is great value in the cost side of the equation when a company can add to what Service Corporation International (SCI) used to call their “local cluster” of funeral facilities.

I once purchased a smaller competitor funeral home that on the surface did not look like a large and profitable acquisition. However, the combined operations of our historical funeral home with that acquisition led to much greater operational efficiencies and profitability. Purchasing that smaller funeral home was one of the best financial decisions that I ever made.

From what I hear, 2021 may be a very busy year in the death care merger and acquisition theatre. If that is true and you are one who may be thinking of selling your funeral home. . . . make sure you know who is in a position to prosper greatly with your funeral home as an addition to their existing operations.

Highest price is not always the main goal of someone selling a funeral home. However, if that does make a difference to you, it may be that the competitor next door is the best possible suitor. . . make sure that they know you are for sale if you want the best possible financial results.

And, for many of you who think your funeral home is too small for that conglomerate. . . . maybe it’s not. It’s probably smart to know where some of those companies have concentrations of going concerns. . . .Here’s some maps. However, someone in the death care brokerage business can probably help you in knowing where these companies are interested in acquiring funeral homes. . . I’m guessing a broker company will be worth what you pay them.

Maps may not be current – we have relied on company websites for maps

- Park Lawn Corporation

- StoneMor Partners Inc

- Carriage Services

- Arbor Memorial

- Foundation Partners Group

- North Star Memorial Group

- Service Corporation International

- Rollings Funeral Service

- Newcomer Funeral Service Group

- Legacy Funeral Group

More news from the world of Death Care:

- “Very difficult time for us”: Portland funeral home manager shares how they’ve adapted during pandemic. News video and print article. Fox 12 – Portland (OR)

- Texas Funeral Service Commission investigating Golden Gate Funeral Home. News video and print article. Spectrum News 1 – San Antonio TX.

- West Hawaii veterans cemetery slated for expansion. West Hawaii Today

- Rise in cremations during Covid-19 pandemic takes toll on Scottsdale neighborhood’s air quality. KJZZ Radio (AZ)

- Family recovers body after weeks of silence from funeral home. WMTW ABC (ME)

Enter your e-mail below t0 join the 1,995 others who receive Funeral Director Daily articles daily: