Have investors lost faith in Death Care?

If you are an investor — and with IRA’s and 401K plans virtually everyone is in today’s world — the month of November 2023 gave you reason for optimism.

After a couple of sluggish years of investor equity growth there now seems to be a light at the end of the tunnel with the thought of inflation slowing down and the potential for interest rates to be dropping next year. Those thoughts have pushed year to date (YTD) investor returns in the common indexes up for the year.

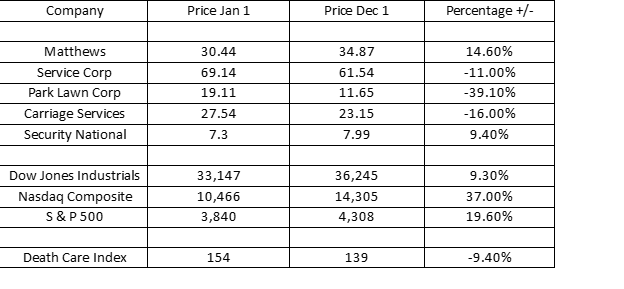

As of Friday, December 1, the large capitalization Dow Jones Industrial average is up 9.3% on the year, the small company S&P 500 composite is up 19.6% on the year, and the technology loaded NASDAQ composite, somewhat fueled by the rage and hope of Artificial Intellegence (AI) is up a whopping 37% YTD.

However, when we look at our Funeral Director Daily Death Care Index (DCI) which represents public companies that are in the death care realm, we see year-to-date returns on the negative side of zero. The DCI composite stood at $153.53 on January 1 of this year and at $139.20 on Friday — a drop of 9.4% year-to-date.

So, while the DCI value represents only five public companies and is a small sample of all death care companies, one must wonder why is an investment in death care lagging the other composites? Historically, death care, and more specifically, the funeral home and cemetery segment has been a relied upon investor port in the seas of turbulent financial times. However, we did not see that in this latest equity downturn. . . . why?

There might be several reasons. . . .it may be as simple as investors believe that companies in the death care industry were busier than usual during the pandemic years and these investors may be sitting out until things return more to a normal situation. Or, it could be that savvy investors believe that death care is going through fundamental changes — an increased rapidity of services moving from burials or cremations with services to more and more deaths going to a simple direct cremation with no services philosophy — which would greatly reduce revenues per service and maybe even change the future mode of death care from funeral home transactions to online transactions without face-to-face funeral home interaction.

To that thought process, one of my readers recently sent me this note about trends with his clients, “Low end cremation is rising. I regularly ask my clients to run an analysis for at need cremation and burial results, excluding those accounts that have gone pre need to at need and the results are an eye opener for the future cash flow and labor needs.”

So, on the one hand I believe investors are wary of the potential for lower revenues per service moving forward and what that might mean to those operations with high fixed overhead costs such as traditional funeral homes with large staffs and costly physical structures. On the other hand, it is pretty well documented that the numbers of deaths in America will be rising, simply from a demographic statistic, in the next decade and even longer.

My take on this lack of positivity in death care investing is that many investors just don’t have a clear enough direction on how that dynamic of more deaths but less spent on each death will have on a funeral home’s bottom line. And, instead of making investments without more clarity on that issue they are just sitting on the sidelines of death care and investing in what they believe are parts of the economy with more clarity moving forward.

Tom Anderson

Funeral Director Daily

When you look at the Death Care Index, two companies have actually had a gain in stock value YTD. They are Matthews International and Security National Financial Corporation (SNFC). I would contend that there are portions of those businesses, outside of the funeral and cemetery business, that is driving that positivity. With Matthews I would suggest it is their foray into the electric vehicle market supplies and with SNFC I would contend that it is their mortgage and insurance divisions which is driving their value upward.

When you look at the three public companies predominantly in the funeral and cemetery sphere — SCI, Carriage Services, and Park Lawn Corporation — you see a combined drop in stock value of 14.9% in a marketplace YTD where the major indexes are gaining from 9% to 37% YTD. When you look at it from that perspective, it is telling that “Death Care is certainly out of popularity” with investors at this time.

Here’s how these stocks and indexes have fared so far in 2023:

This is again one of my columns where I don’t have any answers but like to ask questions. While there doesn’t seem to be an interest in public death care stocks from the investing public at this time one might argue that the money available from Private Equity is widely available for death care investments. We just saw a private equity company acquire InvoCare in the South Pacific and we know from documents that became public that Park Lawn Corporation had an asset management company willing to back them if they went forward with a potential investment or purchase of Carriage Services.

Maybe it’s just how one sees the future from their personal viewpoint. . . . “The glass is either half-full or the glass is half-empty” . . . . . depending on how you see it from your viewpoint.

Disclaimer — The author of this article for Funeral Director Daily holds stock positions in Service Corporation International, Park Lawn Corporation, and Security National Financial Corporation.

More news from the world of Death Care:

- Why I love going to funerals. The American Jesuit Review

- New sign at Poorhouse Cemetery. Livingston County News (NY)

- Graves of American Revolution soldiers found at Hudson Valley Cemetery. Spectrum News 1

- Martin adds to services 100 years into business. The Clanton Advertiser (AL)

Enter your e-mail below to join the 3,407 others who receive Funeral Director Daily articles daily:

“A servant’s attitude guided by Christ leads to a significant life”