Death Care Index takes step backwards in 2022

It will come as no surprise to any of you who pay attention to the investments in your 401k or IRA accounts, but the Funeral Director Daily Death Care Index (DCI) took a step backwards in monetary value during the calendar year 2022. The DCI now measures five companies with a business component in the death care industry as to their cumulative stock price total.

Those companies that we measure and keep tracking on include four companies that own and operate death care retail facilities such as funeral homes and cemeteries. Those four companies are Service Corporation International, Carriage Services, Park Lawn Corporation, and Security National Financial Corporation. The 5th company is Matthews International which is a corporate conglomerate who’s largest revenue component comes from their Memorialization segment which includes casket, monument, cremation, and cremation equipment sales. The DCI numerical value is representative of owning one share of stock in each of the five companies.

As many of you may know, the Funeral Director Daily DCI started with eight public companies but the index lost preneed insurer Assurant a couple of years ago when they sold their preneed insurance business. Then, in 2022, funeral home and cemetery operator StoneMor privatized their company and casket manufacturer Batesville was rolled out of public company Hillenbrand and sold to become a private company. All figures used in today’s barometer of the market have been recalibrated to use only the five remaining public companies in the DCI.

For the calendar year 2022, the Death Care Index has dropped 23.9% of its value from a cumulative total of $211.40 on January 1, 2022, to a closing number of $160.94 as of the close of business on December 30, 2022 . . the last day of an operating stock market in 2022. All five companies comprising the DCI had a loss of value. Service Corporation International had the smallest percentage loss at 2.7% for the year while Carriage Services dropped from $64.44 per share on January 1, 2022, to $27.55 per share on December 30, 2022 — a drop of 57.3% in value for the year.

In contrast, the major stock market indexes dropped between 9.0% for the Dow Jones Industrials and 30.1% for the NASDAQ Composite. The S&P 500 Index dropped 19.5%. That leaves the DCI somewhat right in the middle of those composite numbers at a loss of 23.9%.

Here’s what Seeking Alpha said about the investment year in review:

“Wall Street closed out the year on Friday with its worst yearly performance since the financial crisis in 2008. The benchmark S&P 500 fell nearly 20% in 2022, while the tech-heavy Nasdaq Composite lost a third of its value with a 33% drop for the year. The blue-chip Dow ended about 9% lower. After three years of relentless gains – including through a pandemic – markets came back to earth in 2022. The rollercoaster year saw a war between Russia and Ukraine, surging inflation, and the Federal Reserve hiking rates for the first time since 2018. With economic data through 2022 suggesting that the rising interest rates have yet to really cool the economy, worries have risen that the Fed will tighten policy too far which could tip the economy into a recession. Heading into 2023, these concerns are expected to continue to weigh on sentiment.”

Funeral Director Daily take: It’s easy to look at these numbers and say, “Wow, we had a bad year”. However, you have only taken a loss on a stock if you sell it when it is down. A business may not be performing as bad as the stock indicates. . . sometimes it is just the “time we are in”.

Tom Anderson

Funeral Director Daily

For instance, when I ran my own funeral home I can remember having months of 3 death calls and months of 35 death calls. Yet, we were the same business, on the same trajectory of long-term growth during both of those months. And, over time numbers balanced out and we continued to move forward. One of the problems with public companies is that prices change every day and we can get fixated on that. You have to ask yourself, “What is the correct timeline to look at if a company is moving forward and becoming more valuable or when is it moving backward and becoming less valuable?”

Is that time period to evaluate a company a week? . . a month?. . .a year? . . or a decade?. . . I think it is a judgment call and some investors just have more patience than others.

For instance, if we go back to the DCI over a two year time span, we will see that it has risen from $140.25 on January 1, 2021, to its point of the other day, December 30, 2022, — $160.94. So, over a two-year span the Death Care Index has risen by 14.8% or an annualized gain of about 7.4% which is pretty fair in my book.

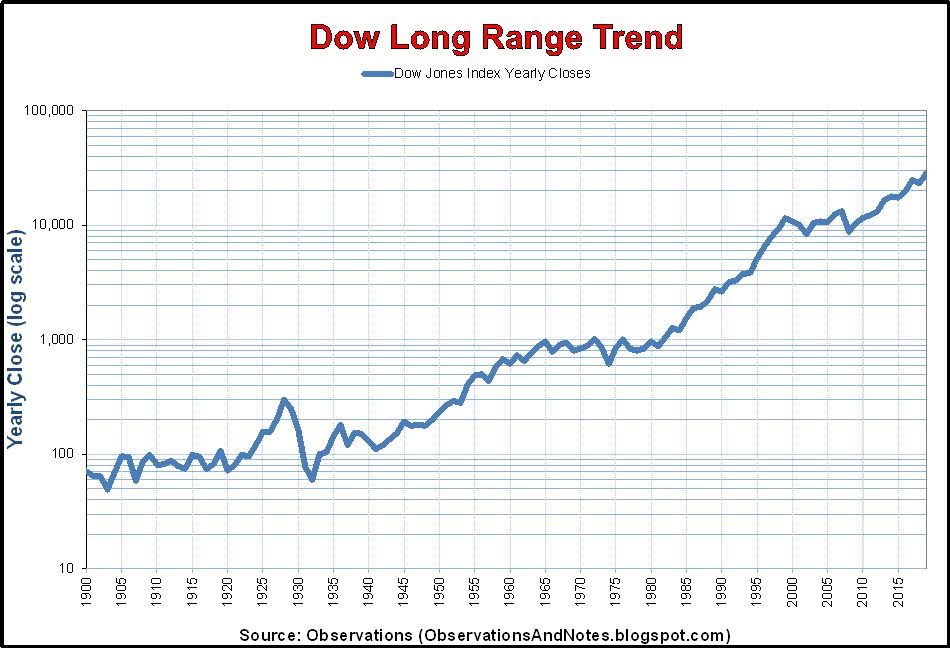

When looking at public companies I suggest you look at them over time. While there may be bad times, they generally get better and the market rewards companies who move forward. This is one of my favorite graphs — it is the Dow Jones Average over the past 120 years. . . . in that time there has been bad times, but those who persisted were generally rewarded.

Dow Jones Long Range Graph

Like most things, stock prices and company values need to be looked at with perspective over time. . . . do you do that?

Disclaimer — The author of this article holds stock positions in Service Corporation International, Park Lawn Corporation, Carriage Services, and Security National Financial Corporation.

More news from the world of Death Care:

- Eric Trimble named to the National Funeral Board. Quad Cities Times (IL)

- Obituary: Glenn McMillan, age 80. Former NFDA President. Legacy.com

- If you don’t want a GoFundMe funeral. . . . Financial Advisor

- Lessons in Grief and Grace: How one Fayetteville woman centers compassion in death. Fayetteville Observer (NC)

- “Unique lives deserve unique celebrations”: How to have a different kind of funeral. St. Albans Messenger (VT)

Enter your e-mail below to join the 3,076 others who receive Funeral Director Daily articles daily: