Wealth generation, private equity, funeral homes — Will this period last forever?

The Wall Street Journal in this recent article (you may find a paywall here) estimates that over the past 5 years Americans have gained a total of $63 trillion in personal wealth. And, this article from Yahoo Finance states “. . . the top 20% — the high-earning American households — are thriving because they have seen immense gains in their stock portfolios and home values in recent years.”

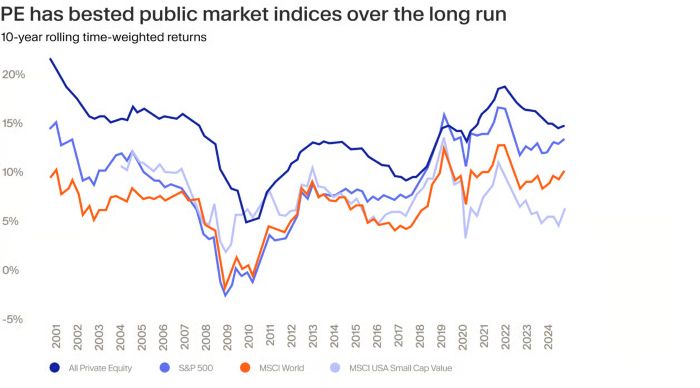

Two results of that personal wealth gain are that Americans are consuming at record levels and these same Americans are continuing to look for more investment opportunities. Part of those investments are going into public stocks and bonds, but I’m guessing that more and more investors, with asset qualifications, are putting money into private equity in growing sums as well. As you can see from the chart below, as good as the public markets have been for asset growth, private equity returns have left them in the dust.

Private Equity returns vs. other returns.

All that money and all of those potential deals leads me to seeing a sign of caution. I’ve always tried to do everything on a level keel. Too much of one thing has never been good for me — as much as I like to golf, three days in a week is enough. Same with a vacation — it’s fun and relaxing, but I always want to get back to work.

Tom Anderson

Funeral Director Daily

So, that brings me to my thought process — with all the money being thrown at businesses, including funeral homes, by private equity, when will the good deals end and somebody in their quest for “growth” make the wrong decision? I don’t know when it will happen and who it will happen to, but at some point the quest for “growth” will lead to bad decisions by somebody.

It just happened in Minnesota with a home remodeling company known as Minnesota Rusco. You can read an article from the Minnesota Tribune here that lets the reader know that Minnesota Rusco, a Minnesota staple since 1955, was acquired by a private equity firm that was “rolling-up” home remodeling firms across the country and now is looking into bankruptcy. Somebody either didn’t know the business that well or know the value of the “local-aspect” of these acquired businesses and it looks like the investment will be lost . . . . and the employees of Minnesota Rusco will probably be on the unemployment line.

I recently came across this article titled “There’s a lot of money in Death”: Funeral consolidation hits Western Mass”. The article goes on to illustrate that even in some smaller funeral homes and roll-ups involving them, that private equity is involved. Here’s the website of a private equity firm which lists Milestone Funeral Partners as one of their investments.

It’s no secret that a large number of family funeral homes will be on the market in the next few years. And, many of them will have the volume and be in a location that will be highly desireable for the national and regional companies to compete for. If you are one of these owners planning to sell, make sure you know your business value and make sure that you know your buyer.

Because . . . . I don’t think the good times will last forever and someone will get hurt when the dominoes fall.

More news from the world of Death Care:

- Gwinnett County approves buffer zone for new funeral homes and crematoriums. WSB Radio – Atlanta (GA)

- Canfield Township allowing backyard burials for family members. WFMJ TV – Youngstown (OH)

- “Feel bad for these families”: Graves underwater at Titusville cemetery after historic flooding. Video news report and print article. News 6 – Orlando (FL)

- Liquified, composted: How green are these alternative death practices? CBC News (Canada)

Enter your e-mail below to join the 3,201 others who receive Funeral Director Daily articles daily

“A servant’s attitude guided by Christ leads to a significant life”