Death Care Index flat Year-to-Date. . . .Carriage Services shows share price growth

There is no doubt that while many investors (and President Trump) have waited for the Federal Reserve to set lower interest rates going forward and negotiated tariff rates lots of other investors have simply stayed invested and have found gains in the stocks of the S&P 500, the Dow Jones Industrial Average, and Nasdaq. Those indexes have returned gains of 10.4%, 7.1%, and 12.6% respectively year-to-date (up to September 5) in 2025.

And, of course, if you had invested in the Morningstar Global Next Generation Artificial Intelligence Index, that you can read about here, your investment would have grown 26.4% year-to-date up to September 5.

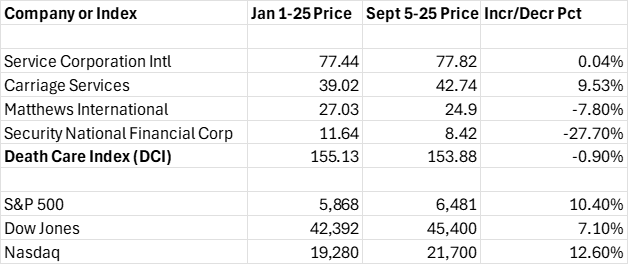

However, if you had put your money into the four stocks that comprise the Funeral Director Daily Death Care Index (DCI) from January 2 to September 5, 2025, you would be sitting on a negative return of just less than 1% for the same time period. The unscientific Death Care Index is comprised of owning one share of stock of each of four public companies that have at least a portion of their revenues coming from Death Care.

Those stocks are Service Corporation International, Carriage Services, Matthews International, and Security National Financial Corporation (SNFC). The DCI had a cumulative value on January 2, 2025 of $155.13 and on September 5, 2025, virtually two-thirds through the calendar year, the DCI rests at a cumulative value of $153.88 — for a decrease in value of just under 1%.

Here’s a graphic of the information contained above:

Carriage Services bucks the trend — Carriage Services stock value increased in the time period from $39.02 per share to $42.74 per share, an increase of 9.53%. As you can see from the chart above they were the only DCI stock to have a measurable gain for 2025’s first eight months.

This article from Yahoo Finance reports keys that management mentioned in their 2nd Quarter 2025 remarks that led to that increase. Included among those key factors were:

- Funeral Segment volume growth

- Strong Preneed sales momentum

- Overhead Cost reductions

- Portfolio repositioning — The divestiture of non-core assets (presumably funeral home and cemetery facilities) coupled with the acquisitions of “higher growth, high-margin properties” (presumably funeral home and cemetery facilities).

Disclaimer-– The author of this article for Funeral Director Daily is a shareholder of Service Corporation International, Carriage Services, and Security National Financial Corporation.

More news from the world of Death Care:

- DFS Memorials advocates for Modern End-of-Life Choices: Embracing direct cremation and personalized celebrations of life. PR Newswire

- Donnellan Funeral Home celebrates owners’ legacy. The Beverly Review (IL)

- Mt. Pleasant Cemetery loses non-profit status. Video news story and print article. KELO News – Sioux Falls (SD)

- Shakespeares who made music part of their family business. Inside Croydon (Great Britain)

- Department of Insurance seeking people who had pre-need funeral contract with Davis Mortuary. Video news story and print article. KRDO Tv – Pueblo (CO)

- Chattanooga owner of cremation service fined by state regulatory board. Chattanooga Times Free Press (TN)

Enter your e-mail below to join the 3,201 others who receive Funeral Director Daily articles daily

“A servant’s attitude guided by Christ leads to a significant life”