Seeking Alpha author: “This is a turning point for Carriage Services to pursue acquisitions and grow its core funeral and cemetery businesses”

A recent opinion article from Seeking Alpha author Lighting Rock Research concludes that “After two years of deleveraging and portfolio optimization, I think this is a turning point for Carriage Services to pursue acquisitions and grow its core funeral and cemetery businesses.”

Here are a couple of bullet points from the article whereby the author thinks Carriage Services is on an upswing.

- “(Carriage Services is) reflecting stable growth and a turning point after two years of deleveraging.”

- “Carriage’s preneed cemetery strategy and normalized growth post-pandemic support steady cash flow and future profitability.”

- “Balance sheet improvements position the company for strategic M&A, with forecasts of 4% organic revenue growth and incremental margin expansion.”

One dissenting bullet point by the author is such:

- “Key Carriage Services risks include leadership transition, competition from low-cost providers, and the need to further reduce high-cost debt.”

Here are some more bullet points from the article, which you can access here:

- “Carriage Services operates 159 funeral homes and 28 cemeteries in the U.S. market, making it a small competitor to Service Corporation International (SCI). The company has recently focused on debt repayment and optimizing its overall portfolios.”.

- “Carriage Services has generated stable growth over the past years, with a 6% revenue growth and 7.1% adjusted EPS growth.”

- “The key message for the quarter was that the company’s business is back on track after two years of debt repayment and divesting non-core business units.”

Comparisons with SCI —-

The article by Lighting Rock Research was published shortly after Carriage Services 2nd Quarter financial reports. Lightning Rock Research also published an article shortly after the 2nd Quarter financial report of Service Corporation International. You can access Funeral Director Daily’s coverage of that article here.

What is interesting about those two articles by the same author is that you can make comparisons on two companies in the Death Care retail business and look for similarities and differences. For whatever reason, Lightning Rock Research sees, as a percentage, future revenue growth higher with SCI than Carriage. The Revenue Growth Rate projections as shown on the charts below indicate a slightly over 6% annual rate for SCI and a slightly under 6% annual rate for Carriage Services.

When it comes to Earnings Per Share, the researcher postulates in his projections that SCI will almost triple its profits in the next decade while maintaining that Carriage Services will slightly more than double their Earnings Per Share over the same time period. At first thought that difference could be seen as SCI using their economies of scale to increase profits. . . . Or, it could be that the author believes that cemeteries will be more profitable than funeral homes over that time period as SCI operates the higher percentage of cemeteries of the two entities.

Here are some charts where you can find some comparative numbers between SCI and Carriage Services that were provided in the articles by Lighting Rock Research:

Current Numbers taken from 10-k report as reported by LIghting Rock Research. (FCF=Free Cash Flow)

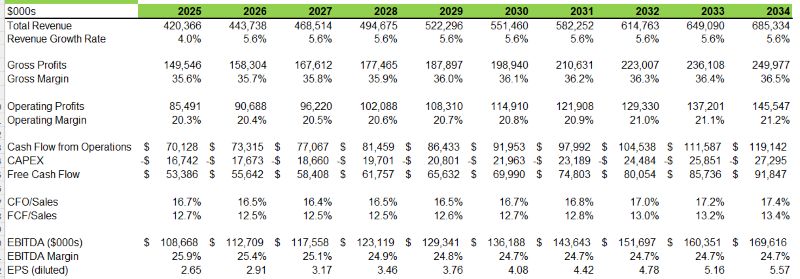

Carriage Services 10-Year Projections from Lighting Rock Research:

Carriage Services Ten-Year Forecast by Lighting Rock Research

Service Corporation International 10-Year Projections from Lighting Rock Research:

Projections of SCI’s Revenue, Operating Profits, Net Profits, and more through 2034 by Lighting Rock Research

Tom Anderson

Funeral Director Daily

Funeral Director Daily take: I always caution myself that when I look at financial reports that the numbers are “one-point, stationary-in-time” numbers. It is my opinion that to get a good feel on the direction of a company you need to look at “trends over time”.

However, these two fairly current articles by the same researcher give us some type of feel as to how that researcher sees the companies from his point of view.

One difference I have with the research is his opinion that his viewpoint that one risk with Carriage Services is “leadership transition”. The founding of the company and the 30-year leadership of Melvin Payne can not be diminished, however, I think that leadership team of the past two years is now in place and will be a strength of Carriage Services moving forward rather than a potential weakness.

Disclaimer — The author of this article for Funeral Director Daily is a shareholder of both Carriage Services and Service Corporation International.

More news from the world of Death Care:

- Risher Mortuary awards “Caring for Others” scholarships. The Downey Patriot (CA)

- Fort Scott National Cemetery Lodge: Standing watch over our nation’s fallen heroes. U.S. Army

- What happened to the bodies from the old North Market parking lot? New memorial proposed. Columbus Dispatch (OH)

Enter your e-mail below to join the 3,199 others who receive Funeral Director Daily articles daily

“A servant’s attitude guided by Christ leads to a significant life”